If Governments Do Not Do More, An Economic Depression Will Occur.

Economist Willem Buiter is sounding the alarm. The global economy is heading for depression due to the restrained approach to the corona crisis. “It’s depressing […]

Gold sales, often synonymous with the term cash for gold, hold a significant potential to fuel economic growth and ensure stability both locally and globally. Governments and central banks strategically leverage gold reserves to fortify their economies, maintain financial equilibrium, and stimulate economic activity.

Gold, historically revered for its value and stability, plays a pivotal role in economic dynamics. The act of selling gold reserves isn’t merely a transaction; it’s a strategic maneuver aimed at shaping economic landscapes. Here’s why:

Central banks and governments adopt various strategies when selling gold reserves. These strategies are tailored to address specific economic objectives and market conditions. Common approaches include:

The repercussions of gold sales ripple through economies, exerting influence on various facets of economic stability and growth:

READ ALSO: Mastering Business Success: How to Invest Your Money Wisely

In the dynamic landscape of global economics, gold sales emerge as a potent tool for driving growth and stability. By harnessing the power of gold reserves, governments and central banks can navigate economic challenges, stimulate activity, and pave the way for sustainable prosperity.

In conclusion, the strategic utilization of gold sales offers a multifaceted approach towards economic resilience and progress. As governments and central banks continue to adapt to evolving economic conditions, the judicious management of gold reserves remains a cornerstone of financial stability and prosperity.

In the digital age, information is power – especially when it comes to finance and investing. Reddit, with its vast array of communities and discussions, has emerged as a valuable resource for traders seeking insights, strategies, and market intelligence. In this article, we’ll explore how Reddit accounts can serve as a catalyst for trading success.

To start leveraging knowledge shared on Reddit, start by getting a Reddit account. Register and create an account or get your Reddit accounts by REDAccs.

One of the key advantages of Reddit accounts is the ability to tap into the wisdom of the crowd. By participating in discussions, sharing insights, and analyzing trends, traders can gain valuable perspectives and information that may not be available through traditional channels. Whether it’s identifying undervalued stocks or predicting market trends, Reddit communities offer a platform for collective intelligence and collaboration.

In addition to crowd-sourced insights, Reddit accounts provide real-time updates and analysis on market movements and economic events. From breaking news to in-depth analysis, Reddit communities offer a wealth of information that can help traders stay ahead of the curve and make timely decisions. By monitoring relevant subreddits and participating in discussions, traders can access the latest market intelligence and adapt their strategies accordingly.

Beyond just accessing information, Reddit accounts allow traders to network and collaborate with like-minded individuals. Whether it’s forming study groups to analyze stocks or sharing trading tips and strategies, Reddit communities foster a sense of camaraderie and collaboration that can enhance trading success. By connecting with others in the community, traders can learn from each other’s experiences, share insights, and support each other’s growth and development.

READ ALSO: The Pulse of Prosperity: How Mortgages Influence the Economy

In conclusion, Reddit accounts serve as a valuable resource for traders seeking to enhance their strategies and achieve success in the markets. By leveraging the wisdom of the crowd, accessing real-time updates and analysis, and networking with other traders, Reddit users can gain a competitive edge and improve their trading performance. So, whether you’re a novice trader or a seasoned pro, don’t overlook the power of Reddit accounts as valuable tools in your trading arsenal.

Access to capital remains a critical factor for startup success in the dynamic landscape of entrepreneurship. However, for individuals with bad credit, securing traditional business loans can be a daunting challenge. Recognizing this barrier to economic participation, governments worldwide have implemented various initiatives to support startup businesses with bad credit. Among these initiatives, startup business loans for bad credit guaranteed have emerged as a cornerstone of government efforts to foster entrepreneurship and economic growth.

Guaranteed startup business loans for bad credit are specialized financing options designed to provide capital to entrepreneurs who may not qualify for traditional bank loans due to poor credit history. These loans are backed by government agencies or organizations, reducing the risk for lenders and increasing the likelihood of approval for borrowers with less-than-perfect credit scores.

One notable government initiative aimed at supporting startups with bad credit is the Small Business Administration’s (SBA) loan programs in the United States. The SBA offers several loan programs, including the 7(a) loan program, which provides guarantees to lenders to encourage them to extend loans to small businesses, including those owned by individuals with bad credit.

Through the 7(a) loan program, eligible startups can access financing for various purposes, such as working capital, equipment purchases, and expansion initiatives. The SBA’s guarantee mitigates the risk for lenders, making it possible for entrepreneurs with bad credit to secure the funding they need to launch or grow their businesses.

In addition to loan guarantee programs, governments often provide financial assistance and resources to support startup businesses with bad credit. This assistance may come in the form of grants, tax incentives, or mentorship programs aimed at helping entrepreneurs navigate the challenges of starting and managing a business.

ALSO READ: Navigating Economic Downturns: Strategies from Property Investment Advisors

For example, some governments offer grant programs specifically targeted at startups in underserved communities or industries. These grants can provide vital funding that does not need to be repaid, helping entrepreneurs overcome financial obstacles and realize their business aspirations.

Furthermore, tax incentives such as tax credits or deductions can help alleviate the financial burden on startup businesses with bad credit. By reducing their tax liabilities, these incentives free up capital that entrepreneurs can reinvest in their businesses, driving growth and innovation.

Mentorship programs are another valuable resource provided by governments to support startup businesses with bad credit. These programs connect entrepreneurs with experienced mentors who can offer guidance, advice, and networking opportunities. By leveraging the knowledge and expertise of seasoned professionals, startup founders can navigate challenges more effectively and increase their chances of success.

Government initiatives play a crucial role in supporting startup businesses with bad credit by providing access to guaranteed loans, financial assistance, and mentorship programs. By addressing the financing needs of entrepreneurs who may face challenges accessing traditional funding sources, these initiatives help foster innovation, create jobs, and stimulate economic growth. As governments continue to prioritize entrepreneurship and small business development, the landscape for startup businesses with bad credit is poised to become more inclusive and supportive.

Indonesia, Southeast Asia’s economic powerhouse, boasts a dynamic stock market brimming with potential. For savvy investors, navigating this landscape requires understanding the latest trends, gauging investor sentiment, and identifying promising sectors. This article delves into the Indonesian market, equipping you with the knowledge to make informed investment decisions. Login to trusted trading brokers in Indonesia like Quotex to get started with your trading journey (https://quotexloginbroker.id).

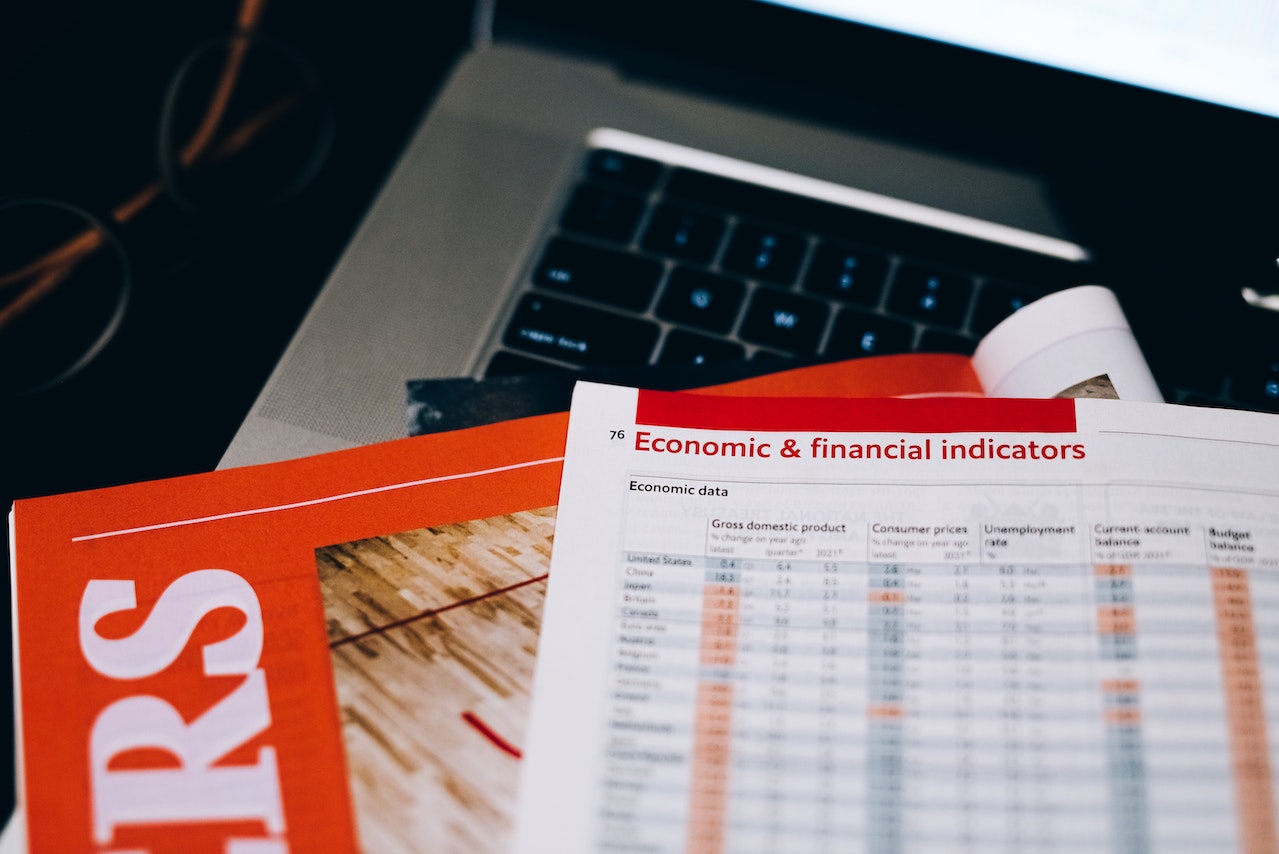

The Indonesian stock market, measured by the Jakarta Composite Index (JCI), has experienced a rollercoaster ride in recent years. While 2023 saw impressive growth of 5.04%, driven by rising commodity prices and domestic consumption, volatility remains a concern. Global economic headwinds and geopolitical tensions cast a shadow, demanding a cautious approach.

Investor sentiment in the Indonesian market is cautiously optimistic. Local investors remain confident in the long-term potential of the economy, buoyed by its young population and rising middle class. However, concerns about inflation and global uncertainties temper their enthusiasm. Foreign investors, on the other hand, are taking a wait-and-see approach, seeking clarity on the global economic outlook before diving in.

Despite the challenges, several sectors present exciting opportunities for investors. Here are some key areas to watch:

Indonesia’s booming digital landscape, fueled by e-commerce, fintech, and online services, offers immense growth potential. Companies operating in this space are well-positioned to capitalize on the country’s tech-savvy population and growing internet penetration.

With a large and increasingly affluent population, demand for consumer goods remains strong. Food and beverage, personal care, and household product companies are expected to benefit from rising disposable incomes.

As Indonesia strives to achieve its sustainability goals, investments in renewable energy sources like solar and wind power are gaining traction. This sector presents an attractive option for environmentally conscious investors seeking long-term returns.

The government’s focus on infrastructure development creates opportunities for companies involved in construction, transportation, and logistics. These investments are crucial for unlocking economic growth and improving connectivity across the archipelago.

READ ALSO: Navigating Economic Downturns: Strategies from Property Investment Advisors

Investing in the Indonesian stock market requires careful consideration. Here are some essential tips:

The Indonesian stock market, with its unique blend of opportunities and challenges, presents a compelling proposition for investors seeking diversification and growth. By understanding the key trends, identifying promising sectors, and adopting a prudent investment approach, you can navigate this dynamic market and potentially reap significant rewards.

The importance of financial privacy cannot be overstated. As we navigate the intricate web of economic transactions, safeguarding our financial information becomes paramount. Cryptocurrency, with its decentralized nature, has emerged as a beacon of financial privacy. In this article, we delve into a critical aspect of ensuring confidentiality in economic dealings – the role of Cryptocurrency Tumblers.

Financial transactions, both online and offline, are susceptible to prying eyes. With the increasing prevalence of cyber threats and data breaches, protecting one’s financial privacy has become a non-negotiable priority. Cryptocurrencies, designed to operate on a decentralized ledger, initially offered a degree of anonymity. However, the transparent nature of blockchain technology has led to the development of sophisticated tracking tools.

While traditional cryptocurrencies promise anonymity, the reality is often more nuanced. Most blockchain networks leave a visible trail of transactions, linking wallet addresses to real-world identities. This inherent transparency poses a potential risk to financial privacy. Enter Cryptocurrency Tumblers – a revolutionary solution designed to obfuscate transaction trails and enhance the confidentiality of cryptocurrency dealings.

Cryptocurrency Tumblers, also known as mixers or shufflers, are specialized services designed to break the link between the sender and the receiver in a cryptocurrency transaction. These services mix and shuffle transactions from various users, making it nearly impossible to trace the origin of funds accurately.

When a user initiates a transaction through a Cryptocurrency Tumbler, the service receives the funds and subsequently redistributes them across multiple transactions, often involving different cryptocurrencies. This complex mixing process creates a convoluted transaction history, rendering any attempt to trace the source futile.

By utilizing Cryptocurrency Tumblers, individuals can achieve a heightened level of anonymity in their financial transactions. This added layer of privacy ensures that sensitive financial information remains confidential, shielding users from potential malicious actors seeking to exploit vulnerabilities.

Blockchain analysis, a method employed to trace and analyze cryptocurrency transactions, becomes significantly challenging when Cryptocurrency Tumblers are involved. The intricate mixing of funds disrupts the linear flow of transactions, confounding even the most sophisticated tracking tools.

In an era where data breaches have become all too common, Cryptocurrency Tumblers act as a crucial line of defense. By obscuring transactional data, these services mitigate the risk of sensitive financial information falling into the wrong hands, fortifying the overall security of cryptocurrency users.

Opt for a Cryptocurrency Tumbler with robust privacy features, such as multi-currency support, time delays, and randomized transaction amounts. These elements contribute to creating a more secure and private transaction environment.

Before selecting a Cryptocurrency Tumbler, delve into user reviews and assess its reputation within the cryptocurrency community. A service with a proven track record of protecting user privacy is paramount for a reliable financial privacy shield.

While financial privacy is invaluable, it’s essential to consider the service fees associated with Cryptocurrency Tumblers. Opt for a service that strikes a balance between affordability and the level of privacy it provides.

Want to learn more about cryptocurrency? You might also want to read this article: The Role of Technical Analysis in Cryptocurrency Trading

In the pursuit of financial privacy, Cryptocurrency Tumblers emerge as indispensable tools. Their ability to obscure transactional trails, protect against blockchain analysis, and safeguard users from data breaches make them a cornerstone in the realm of digital financial security. As we navigate the complexities of the digital economy, integrating Cryptocurrency Tumblers into our transactions becomes not just a choice but a strategic imperative.

The advent of mobile trading apps has reshaped the landscape of global economics, playing a pivotal role in the dynamics of modern-day trading. These sleek and user-friendly tools have seamlessly integrated into the routines of traders worldwide, leaving an indelible mark on market trends and the overall health of the economy.

Mobile trading apps like Exness (https://exness.broker-breakdown.com/exness-login/)offer traders a multifaceted toolkit, revolutionizing their approach to financial markets. With a user-friendly interface and real-time updates, these apps provide unparalleled accessibility, allowing traders to execute transactions anytime, anywhere.

The extensive range of financial instruments available for trading, from stocks and commodities to cryptocurrencies, broadens the scope of investment opportunities. In-depth market analyses, live charts, and customizable alerts empower traders with the data needed to make informed decisions swiftly.

Gone are the days when trading was confined to bustling stock exchange floors. Enter the era of the trading app, where financial transactions are executed with a simple tap. These apps, residing in the pockets of millions, have democratized the world of trading, making it accessible to anyone with a smartphone.

The influence of trading apps extends beyond mere accessibility; they actively shape market trends and contribute to the ebb and flow of the global economy.

Beyond individual portfolios and market trends, mobile trading tools have a profound impact on the broader economic landscape.

However, this digital transformation is not without its challenges and considerations.

As mobile trading apps continue to evolve, what can we expect in the future?

READ ALSO: The Role of Technical Analysis in Cryptocurrency Trading

In the palm of our hands, trading apps have transformed the once-exclusive realm of finance into a global, interconnected marketplace. Their impact on market trends, individual trading strategies, and the overall health of the economy is undeniable. As we navigate this digital age, it is crucial to recognize the opportunities and challenges presented by these tools. With responsible use, robust security measures, and an eye on the future, mobile trading apps are set to remain at the forefront of shaping the global economy.

Cryptocurrency trading has become a dynamic playground for investors seeking opportunities in the ever-evolving digital financial landscape. Amid the volatility and excitement, technical analysis emerges as a valuable tool for navigating the complexities of crypto markets. As we delve into the world of crypto trading applications like Immediate Lidex Ai (immediatelidex.com), it’s crucial to understand the role technical analysis plays and explore the insights provided by seasoned analysts featured in reputable financial sources.

In the realm of cryptocurrency, where prices can soar or plummet in the blink of an eye, insights from technical analysts serve as guiding beacons for traders. Experts featured in prominent financial sources consistently emphasize the significance of technical analysis in predicting price movements and making informed decisions.

In the realm of cryptocurrency trading applications, the real-time nature of transactions necessitates a strategic approach. Technical analysis serves as a compass, aiding traders in making well-informed decisions amidst the rapidly changing crypto landscape.

Experienced analysts stress the importance of combining multiple indicators for a comprehensive view. The synergy between moving averages, RSI, Bollinger Bands, and support/resistance levels creates a robust framework for traders to assess potential opportunities and risks.

As technology continues to advance, crypto trading applications are at the forefront of innovation. These platforms integrate technical analysis tools seamlessly, empowering traders to execute strategies with precision. Real-time charting, customizable indicators, and user-friendly interfaces enhance the overall trading experience.

The phrase “crypto trading application” now signifies more than just a digital gateway; it represents a sophisticated toolkit for traders to navigate the intricacies of the crypto market. The fusion of technical analysis and innovative applications opens new avenues for traders to stay ahead in this fast-paced environment.

In the dynamic world of cryptocurrency trading, where fortunes can be made and lost in an instant, technical analysis stands as a stalwart companion for traders. As we navigate the ever-changing crypto landscape, the insights gleaned from seasoned analysts and the integration of advanced tools within trading applications become indispensable.

In closing, the marriage of technical analysis and crypto trading applications paves the way for a more informed and strategic approach to navigating the digital financial frontier. As we look ahead, the role of technical analysis will likely continue to evolve, shaping the future of cryptocurrency trading.

In times of economic downturn, the expertise of property investment advisors such as the professionals from Nu Wealth becomes invaluable. These seasoned professionals possess the insights and strategies necessary to navigate the complexities of property investment during challenging economic conditions.

When economic tides are uncertain and markets experience fluctuations, property investors often turn to advisors for guidance. The role of property investment advisors is not limited to the good times; in fact, their significance shines most during economic downturns. This article delves into the strategies that property investment advisors recommend to their clients when facing economic challenges.

One of the key strategies recommended by property investment advisors is diversifying your property portfolio. Economic downturns can affect property markets differently, so spreading investments across various regions and types of properties can mitigate risk.

Property advisors assess the potential risks associated with property investments during an economic downturn. They provide their clients with a clear understanding of these risks, helping them make informed decisions.

Advisors closely monitor economic trends, market data, and forecasts. This data-driven approach enables them to anticipate changes in property values and market conditions, allowing clients to make well-informed investment decisions.

Property investment advisors adapt investment strategies to align with the changing economic landscape. Whether it’s adjusting the types of properties they invest in, focusing on income-generating properties, or capitalizing on emerging trends, their strategies evolve with the market.

Advisors often emphasize the importance of a long-term investment horizon. Economic downturns are typically temporary, and a focus on long-term gains can help investors ride out the storm.

ALSO READ: Understanding Payday Loans and Their Impact on the Economy

Property advisors may recommend more hands-on property management during economic downturns. Efficient management can help maintain property values and rental income.

Advisors stress the need for financial preparedness, including maintaining cash reserves to cover expenses during challenging times. This financial buffer can prevent the need for distress sales.

Property investment advisors work closely with tax experts to develop tax-efficient strategies. Minimizing tax liabilities is essential to maximize returns during economic downturns.

Advisors help clients create exit strategies, which can include selling underperforming properties or exploring options like refinancing when favorable terms are available.

Economic downturns may offer opportunities for strategic reinvestment. Advisors guide their clients in identifying value deals and growth potential in weakened markets.

Property investment advisors play a crucial role in helping investors make sound decisions during economic downturns. By following these recommended strategies, investors can protect their property portfolios and emerge from challenging times in a strong position.

In today’s fast-paced business landscape, mastering the art of financial investment is essential for sustainable success. Entrepreneurs and business owners alike must navigate the intricate world of finance to ensure their ventures not only survive but thrive. One powerful tool in this journey is social media, with Instagram leading the pack. In this article, we’ll delve into the key principles of investing your money wisely, explore the potential of Instagram as a promotional platform, and understand how third-party companies can boost your online presence with Instagram growth service.

Investing your money wisely is akin to sowing seeds for a bountiful harvest. It’s not just about saving for the future; it’s about making strategic decisions to fuel your business growth. Here are some fundamental principles to guide your investment journey:

One of the golden rules of investing is not putting all your eggs in one basket. Diversification spreads risk and can lead to more consistent returns. Explore various investment options, including stocks, bonds, real estate, and even cryptocurrencies, to create a balanced portfolio tailored to your risk tolerance and financial goals.

Before diving into the world of investments, it’s crucial to understand the basics. Read books, attend seminars, and consider consulting with a financial advisor. Knowledge is your best ally when making informed financial decisions.

Investing isn’t a get-rich-quick scheme; it’s a marathon, not a sprint. Maintain a long-term perspective and resist the urge to panic during market fluctuations. Staying the course can lead to substantial rewards over time.

Establishing a strong relationship with a reputable financial institution can provide invaluable support on your investment journey. Banks and credit unions offer a range of services, from savings accounts to investment advice, to help you achieve your financial goals.

Instagram, with its 1 billion monthly active users, has become a powerhouse for businesses looking to connect with a global audience. Leveraging this platform can significantly enhance your brand’s visibility and engagement. Here’s how businesses can thrive on Instagram:

Instagram is a visual platform, making it ideal for showcasing your products or services. Utilize high-quality images and videos to tell a compelling story about your brand, creating an emotional connection with your audience.

Interacting with your followers is key to building a loyal community. Respond to comments, host Q&A sessions, and run contests to keep your audience engaged and invested in your brand.

To truly master Instagram for business, consider enlisting the help of an Instagram growth service. These third-party companies specialize in increasing your followers, likes, and overall engagement. By leveraging their expertise, you can expedite your Instagram growth and focus on other aspects of your business.

Instagram offers valuable insights into your audience’s behavior and preferences. Use these analytics to fine-tune your content strategy, posting schedule, and advertising campaigns for maximum impact.

In an increasingly digital world, the significance of physical currency may seem diminished. However, coins and banknotes still hold relevance, especially in certain financial aspects:

While digital payments are on the rise, physical currency remains essential for many daily transactions. Whether it’s tipping a service provider or making small purchases, coins and banknotes continue to play a vital role in our lives.

Coins and banknotes can hold significant collector’s value. Rare and old currency can be sought after by numismatists, making it a potential investment avenue for those with a keen eye for collectibles.

Banks and financial institutions continue to provide services related to physical currency, including currency exchange and secure storage. These services cater to both individual and business needs, ensuring your financial journey remains versatile.

READ ALSO: Role Of Economy In Shaping The Future

Mastering business success involves making smart financial choices, harnessing the power of social media platforms like Instagram, and adapting to the changing landscape of currency. By diversifying your investments, embracing Instagram as a promotional tool, and understanding the role of physical currency, you can position your business for long-term prosperity. Remember, the journey to success is a continuous one, filled with opportunities for growth and learning.

In today’s rapidly evolving world, the concept of the learning economy has gained immense importance. Learning about the economy represents a shift from traditional economies that rely on tangible goods and services to an economy driven by knowledge, skills, and continuous learning. This paradigm shift is not just a buzzword but a fundamental transformation that impacts individuals, businesses, and societies at large.

In the digital age, change is constant, and the pace of innovation is relentless. To thrive in such an environment, individuals and organizations must continually adapt and learn. Learning about the economy promotes a culture of adaptability, enabling individuals to acquire new skills and update existing ones. This adaptability is vital for career growth and business sustainability.

Innovation is the lifeblood of economic progress. Learning economy encourages entrepreneurship and innovation by providing the knowledge and tools needed to create new products, services, and business models. This, in turn, drives economic growth and job creation.

Burra Robinson Family Lawyers (https://www.brfamilylaw.comhau/our-services/divorce/) of Perth, WA, noted that Australia’s divorce rate has been on the rise since 2021. Many believe that the upward trend is a dire consequence of the COVID-19 lockdown. The difficult and challenging conditions of the period had put relationship to a test, which unfortunately resulted in the breakdown of marriages.

Burra Robinson Family Lawyers (https://www.brfamilylaw.comhau/our-services/divorce/) of Perth, WA, noted that Australia’s divorce rate has been on the rise since 2021. Many believe that the upward trend is a dire consequence of the COVID-19 lockdown. The difficult and challenging conditions of the period had put relationship to a test, which unfortunately resulted in the breakdown of marriages.

While studies show that domestic violence is the leading reason why divorce cases continue to rise in Australia, separating couples no longer have to prove who is at fault in the breakdown of the marriage. The Family Court though wants couples to undergo a 12-month separation period as a means of determining if they truly want out of the legal union.

If so, they can jointly or solely apply for a divorce online. Since the Family Law Act 1975 modified the divorce proceedings into a no-fault divorce system, many believe it’s the underlying reason why the country’s divorce rate is on a continuing rise. After all, applying and getting approved for a divorce is no longer a tedious and hostile procedure.

Binding Financial Agreement or Separation Agreement – A document containing a concurrence between both spouses regarding the distribution and division of marital assets acquired during marriage using commingled marital funds. In the discussions, legal representation is best for each spouse, to ensure that the division of marital assets is fair and equitable.

Binding Financial Agreement or Separation Agreement – A document containing a concurrence between both spouses regarding the distribution and division of marital assets acquired during marriage using commingled marital funds. In the discussions, legal representation is best for each spouse, to ensure that the division of marital assets is fair and equitable.

Child Custody Agreement Under Australia’s family laws, both the mother and father have equal responsibility in caring for and raising the children. However, equal sharing of children is true only if there is no occurrence of domestic abuse and violence.

Spousal Maintenance – Without prejudice to the marital asset distribution agreement, a petition for spousal maintenance may also be filed with the Family Court as part of the divorce proceedings. Still, when approving a petition for Spousal Maintenance, the Family Court considers certain economic factors that give rise to a partner’s financial need; or factors that affect an ex-partner’s capability and ability to provide spousal financial support.

Examples of such factors include age, current health and medical conditions, employment status, financial obligations, below 18 years old child/children in their mutual care.

The spousal maintenance that the Family Court approves is usually non-permanent. It will last until such time that an ex-partner regains her or his ability to find and keep a decent paying job. Yet if a former wife or husband lost his or her physical or mental ability to land a good-paying job as a result of an abusive or unhealthy marriage, the Family Court could order the payment of a permanent spousal maintenance.

The economy is an intricate web that weaves through every aspect of your life, influencing your choices, opportunities, and aspirations. At its core, the economy encompasses the production, distribution, and consumption of goods and services within a society.

The economy acts as the backbone of modern civilization, shaping the very fabric of society. It determines the availability of jobs, the cost of living, and the overall standard of living. Whether you’re buying groceries, planning a vacation, or pursuing higher education, the economy plays a pivotal role.

Economic conditions shape your consumption patterns. When the economy is thriving, consumer spending tends to rise, driving demand for goods and services. During economic downturns, cautious spending becomes prevalent as individuals prioritize essential needs over discretionary purchases.

Understanding the economy is critical for individuals, businesses, and governments alike.

For individuals, understanding the economy can help them make informed decisions about their finances. They can learn how to manage their money effectively, invest wisely, and plan for their future. For businesses, knowledge of economic principles can help them make strategic decisions about pricing, production, and expansion. And for governments, understanding the economy is crucial for creating policies that promote growth and stability.

Economy refers to the production, distribution, and consumption of goods and services within a society. It affects everything from job opportunities to prices of goods and services to our standard of living.

A healthy economy benefits everyone in society by creating jobs, increasing productivity, and promoting innovation. On the other hand, economic downturns can lead to job losses, reduced incomes, and financial instability for individuals and businesses alike.

The economy is one of the most important parts of your life. It is the driving force that keeps you going and lets you live your life according to your needs. It is also one of the most complicated things in life to understand.

The economic system is made up of many different sectors and industries. These are made up of many different parts, which are all interdependent on one another.

The job market has changed significantly over the years. In the past, people would have to stay in one place for their entire careers. Today, people can move around the country or even across the globe to find work that they enjoy doing. This has led to a lot of new jobs being created. It has also led to a lot of old jobs disappearing because they were no longer needed or replaced by technology.

The economy is the backbone of society. It shapes your future and affects your life in more ways than you can imagine.

The economy plays a crucial role in shaping your future, as it affects every aspect of your life. It determines how you allocate and distribute resources. This affects employment opportunities, wages, prices of goods and services, investment opportunities, government policies and regulations, and much more.

It is important to understand the role that the economy plays in shaping your future. This way, you can make informed decisions about how best to use the resources available to you. By understanding how economic forces work together to shape your future, you can make better decisions about where to invest resources for maximum benefit.

Economic policies are essential for growth. For example, countries that maintain open markets for both domestic and international trade are generally more successful than more closed economies where the government actively intervenes in markets.

Political and economic institutions are also determining factors. For example, countries with governments governed by written constitutions, independent judicial systems that enforce contracts, low bureaucratic costs, and economic stability.

Certain structural characteristics also affect growth. Geography affects the costs of trade, the productivity of the labor force, and the returns to agriculture, among other factors.

Mastering the fundamentals of the economy makes it possible to decipher economic news. You can do this in a more structured way with models and tools to be applied in reasoning. This makes it possible to create links between the different events, points of view, and currents of thought.

Admittedly, economists do not always have enough information to know. You also do not know exactly the world’s oil supply on which you can count or the resources required to eradicate famine.

However, thanks to the knowledge acquired in the field of economics, you can become a better manager.

Knowledge of the economy still makes it possible to be a better citizen. This is especially possible in the context of economic and social crises. Professionals and students in vocational training, for example, can acquire economic reasoning.

Technically speaking, economic growth means a change in gross domestic product. An example is the sum of the economic goods produced in an economy expressed in values, from one period to the next.

Nominal economic growth defines growth as a monetary change in GDP or gross national income. In the case of real economic growth, you subtract the price increase.

The term economic growth also includes medium- or long-term growth. It is also a trend growth that results if one disregards the temporary seasonal and cyclical fluctuations in economic development. Economic growth in this sense is the subject of theoretical and empirical economic research. It is one of the main goals of economic policy action.

The economic principle includes the economical use of scarce resources. Management is necessary because the goods to satisfy needs are limited, but needs are practically unlimited. The “economic principle” demands that scarce goods be used in such a way that the best possible relationship between the satisfaction of needs and the consumption of goods is achieved.

The principle of economic efficiency and the level of costs are loosely related. The obligation to act economically does not mean that the cheapest offer always has to be chosen. The cheapest is not always the cheapest and therefore the most economical. Aspects such as reliability, durability or special regional conditions can influence the decision.

The economic principle states that the best possible relationship between expenditure and income must be achieved.

Bitcoin is a digital currency that was launched in 2009 as a revolutionary financial tool intended to eliminate the vulnerabilities of fiat currencies and traditional banking systems.

It is decentralized and was developed as an alternative for cheaper and faster money transfers. Bitcoin has quickly become one of the most valuable financial assets on the market. Still, most people agree that bitcoin is good for the economy.

The success of bitcoin has impacted the emergence of several cryptocurrencies that operate on the bitcoin model and technology. This has created an entire cryptocurrency industry with vast reserves held by institutions and individuals around the world.

Bitcoin’s outstanding performance has also fueled its global demand, creating opportunities for cryptocurrency miners, currency exchange companies, forex trading platforms, and investors. Bitcoin is expected to create more chances for economic development as it becomes more widespread in the mainstream sectors.

Bitcoin offers positive effect to the economy because it supports numerous financial transactions just like fiat currencies. Although some countries have excluded bitcoin, countless countries around the world accept bitcoin as a store of value and medium of exchange. Today, several large, medium, and small businesses accept bitcoin as a form of payment.

This means people can use Bitcoin to buy goods and services. People can use bitcoin 360 AI to acquire investments globally. In addition, you can use bitcoin on forex trading like other financial instruments.

Globally, more than a third of the adult population does not have banking facilities and services to turn to in the event of a financial crisis. This denies them access to credit and other essential financial support, further fueling economic turmoil.

Bitcoin offers these financially disadvantaged populations excellent opportunities for easier access to capital.

Bitcoin is a decentralized currency that allows individuals and businesses to exchange money without restrictions across international borders. This means that even people without a bank account can easily send and receive money for private and business use.

Most people, especially in developing countries, are reluctant to invest because of the bureaucracy and corruption in traditional financial systems. Although bitcoin cannot eliminate corruption and bureaucracy, it offers its users better protection against such risks.

That’s because bitcoin transactions are encrypted in blocks of data and digitized that only users have access to.

The transparency of Bitcoin transactions greatly reduces the risk of financial crimes such as corruption and fraud. This enables individuals and companies in developing countries to participate in global financial transactions, thereby improving their economic and social standards.

Did you know local small businesses such as towing services improve your life every day? Without small businesses, you would be missing out on a ton of amazing benefits.

Small companies may be limited in size, but their importance to developed and developing economies is enormous. According to the World Trade Organization, small and medium-sized enterprises in developed countries account for over 90% of the business population, 60-70% of jobs and 55% of GDP. When you support a small business like Towing Service San Jose, you also support the local community in which it is based. Spending your money there will help stimulate the local economy. Find local towing business in San Jose, California. Find them on the map – https://maps.app.goo.gl/HgmB8MtTgA12xBRm7.

Small, micro, and medium-sized businesses are accountable for more than two-thirds of all jobs globally. In addition, they account for most of the newly created jobs.

Not only do local businesses help community members with more job opportunities, but they also support other local businesses. By sourcing materials for their own business locally, more of the money stays in their community.

Small businesses also play part to the distinctiveness of the local community in which they operate. Since many small entrepreneurs are very appreciative of community support, they are often happy to reciprocate by attending community events and donating to local charities. It is about being an active member of the community and improving the community on different levels.

Small businesses have the greatest impact on local communities by enriching your neighborhoods with their unique products and services. Most small businesses are run by people and not by boards or interest groups. They reflect the personality of the owner.

Because many small businesses must compete with bigger establishments, they are continually working to offer new products and services and bring new benefits to their customers. This encourages small businesses to innovate and offer unique products to keep customers coming back.

At the same time, smaller companies are more quickly able to keep up with changing customer demands. Therefore, it is often independent, small companies that are innovative and create and offer new opportunities.

One of the main goals of national economic policy everywhere in the globe is economic growth. This creates jobs, solves social conflicts and facilitates structural change. Because of growth in the economy, government can invest more money in development aid and environment protection.

Economic growth means that an economy produces more and better goods and services than in the past. Economic growth is particularly important when these goods and services lead to an increase in the standard of living of broad sections of the population. In other words, everyone should benefit from economic growth. History shows that economic growth has indeed lifted many people out of poverty, disease, or unemployment. In addition, of course, economic growth also helps to finance the welfare state.

There is an ambivalent interrelationship between the economy and the environment.

On the one hand, the natural environment is the basis of all life and business. It provides resources, absorbs waste products and provides living space. A modern society at today’s level of prosperity would be unthinkable without the natural foundations.

However, raw materials such as crude oil, ores, fresh water or land are not available in unlimited quantities. Biodiversity is threatened and therefore finite. And the atmosphere and ecosystems can only absorb carbon dioxide and pollutants to a certain extent.

On the other hand, an efficient economy and a high level of prosperity are the basis for improved environmental protection and sustainable development. After all, dynamic, market-based economies are better able than stagnant economies to produce environmentally friendly innovations.

You can express the change in the gross domestic product of an economy in terms of economic growth. Thus, it can be both negative and positive.

The great importance of economic growth in a national economy is omnipresent. You may encounter the term economic growth almost every day in daily newspapers or news formats. The development of jobs, tax revenues of the state and thus also of the social security funds are directly related to the growth of the economy.

This represents the increase in the gross domestic product of an economy. It indicates the value of all goods and services that an economy generates often related to one year.

Economic growth, in turn, is reflected in the rate of change in real gross domestic product.

The reason for the increase in performance, i.e. for economic growth, can be better utilization of production capacities.

Are you aware that economic growth resources are directly related? If people provide products or services, they require resources. At least, some of which are non-renewable raw materials. This is counteracted by increases in efficiency, through which the same GDP can be generated with fewer resources. As a result, resource efficiency can increase and the economy can grow.

One of the main goals of national economic policy almost everywhere in the world is economic growth. Arguably, growth raises the population’s standard of living and creates jobs. It can also help solve social conflicts better and enables structural change. Eventually, it is possible to spend more money on activities such as development aid and environmental protection.

Entrepreneurs can transform the way you live and work. If they are successful, their revolutions can improve your standard of living. In short, they not only create wealth from their entrepreneurial ventures but also create jobs and the conditions for a thriving society.

Entrepreneurial ventures literally create new wealth. Society can limit existing businesses to the scope of existing markets and reach the glass ceiling in terms of income. Entrepreneurs’ new and improved offerings, products or technologies enable the opening of new markets. Also, they can help create new wealth.

The main function of the economy is to explain facts and phenomena related to the production, exchange and consumption of goods and services. It studies the behaviour of organizations and individuals involved in economic activities. It also studies the reasons that lead them to carry out these activities.

Economics formulates laws and principles that people use not only to explain but also to predict the occurrence of economic facts and phenomena and to influence their development.

Explain economic facts and phenomena;

Predicts the production of economic facts and phenomena;

Proposes ways to influence the way economic facts and phenomena unfold.

The current economy undermines your prosperity because it destroys the natural basis of economic activity. Therefore, the transition to a green economy that is in harmony with nature and the environment is necessary.

Green Economy is a new model for economic development. It combines ecology and economy in a positive way and thereby increases social welfare. The goal is an economy that is in unison with the environment and nature. The transition to a green economy needs a comprehensive ecological modernization of the entire economy. In particular, you must change resource consumption, emission reduction, product design and the conversion of value chains. The promotion of environmental innovations is of central importance.

In recent years, the term circular economy became extremely popular. People see this as an answer to the worldwide environmental crisis that is affecting the whole world.

As the name suggests, this form of the economy requires a nonstop system of production. It requires the reuse of resources and wastes that many fields can use. There are already initiatives in this regard, albeit only on a small or medium scale.

The purpose of the circular economy is to barge in the classic sequence of production– raw materials – processing – consumption – waste. Specifically, it aims to take the waste and put it back into production. Thus, the cycle looks something like this: raw materials – processing – consumption – reuse of waste in production. And then the process starts from scratch.

For many years the United States Government encouraged American businesses to sell their products overseas. However, for the recent years America is buying more goods than they sell t other countries.

Moving further here are some vocabulary we should first understand, import is buy goods from other countries and export, is to sell goods to other countries. A trade deficit occurs when you import more goods to other countries than you export. Trade agreements are made when countries when the government encourages trade between their countries. A trade agreement is just what it sounds like. It is an agreement among two or more countries that increases trade by making it more beneficial for both parties. But when they want to discourage trade among their countries, a trade barrier is formed. This is an obstacle to trade between two or more nations. A good example of a trade barrier is tariff or a tax on imported goods. Tariff make it more expensive to buy or sell imported products and therefore discourage trade.

We have what is called a traditional economy which involves hunting and gathering, basic sustenance farming, herding cattle etc. This type of economy is in very short supply in today’s world. The two basic forms of modern economy are the market economy or capitalism in which a free exchange of goods happens with the government intervention. We also have the planned economy in which the Government has total control over the means of distribution, such as Communism and Socialism. Most economies are mixed economy which is a combination of planned and market economy. Planned and Market economy is not complex. In every situation, if you have something that is scarce, you have to figure out a way of distributing this resource. Scarcity exists when not enough of a commodity is available to satisfy all of the wants at a zero price. When this happens economies usually ration. This is a way of rationing resources. A rationing system is just a way of distributing or who gets what. In the free market prices indicate this. In the planned economy it will be the Government to decide.

We as humans are incredible in creating and inventing things. We are seriously skilled and talented and we continue to becoming better. As we do so, there is an opportunity to redesign and rethink on how we create things. Can we design products that is made and can be made again? And can we power the whole system with renewable energy? Can our innovation and creativity build an economy that can restore and regenerate? The answer is Circular Economy. This replaces the traditional linear model in which we dig stuff out of the ground, turn it into something, consume it and then put it back to the ground as trash. There are many issues that we should address to have a more sustainable future. Each of us have the potential to help achieve this. Here are a few things we can do to practice circular economy to achieve a sustainable future.

There are many factors that causes economic recession or depression. The most common reason for economic reason is mostly political, the Government and its Central Bank decide to stimulate the economy. The GDP of a country can shrink drastically. This means the output and wealth of its country is also shrinking. If this pattern last for 6 months, then we can consider it a recession. If it last longer than 6 months, and becomes severe then it is termed as a Depression.

The Government can try to minimize recession and stimulate growth through the following policies:

All these actions goal is to aim to increase money supply so that consumers and businesses can borrow more easily and consume and invest even more. Most government target an increase in money faster than the rate of growth which can cause inflation or the rise of prices. A small amount of inflation is seen as a good thing and can be an insurance against recession. However, if Governments are too aggressive in increasing the money supply the rate of inflation increases dramatically causing hyperinflation which can be devastating in economic growth.

Productivity directly impacts the economy. It is defined as the measurement of the efficiency of the production process. It is the relationship between inputs and outputs. This can be applied to the individual factors of production.

Labour Production. This is the most widely used measure and is usually calculated by dividing the total output by the number of workers or the number of hours worked.

Total factor productivity attempts to measure the overall productivity of the inputs used by a firm or a country. The quality of different inputs can change significantly over time. There can also be significant differences in the mix of inputs thus firms and other countries may use different definitions in their inputs especially on capital. The difference in living standards will greatly reflect differences in their productivity. The higher productivity in a country is good for its economy.

Gig is a slang term meaning a job for a specified number of time. This term is often used by bands for a one off musical performance. This word has found its way on the mainstream business vocabulary as more communities nowadays trend to the Gig economy.

A Gig Economy is defined as a free market system in which temporary positions are common. Some good examples of this are Freelancers, Independent contractors, project-based workers and temporary hires. They are also called “Gig Workers.” They are commonly found in many industries. They can be writers, ride share drivers, photographers, accountants, realtors, handy man, tutors or anyone who enters into a formal agreement with a company to provide services without being in the company’s payroll. With the digitization, the workplace now is becoming more mobile. Many employees now can find many jobs across the world and employers can find the best individuals for a job without as much geographic strain. The Gig Economy also saves business resources like benefits, office space, and training while providing employees benefits like the freedom to select jobs or gigs that they are interested in. While this flexibility is appealing, gig workers trade this for little or modest pay, little or no health benefits or retirement benefits.

Protecting our children and teaching them the basic skills if very important to one’s economy. A country with a prosperous economy has a strong foundation that focuses on education. They train the younger generation to perform well. Learning these basic skills through primary education is very critical for a child’s social, physical and intellectual development. Their understanding of basic health nutrition and sanitation is also incorporated into the educational curriculum. All this factors would have an effect to the nation’s economy. The completion of education has proven lasting benefits to the basic unit of the society which is the family. This is also beneficial to the country’s economy.

The world economy is encountering an erosion of globalization. The ties of monetary and business opportunities over the world is wearing away creating more bigger holes in it. Globalization is multidimensional, it is not only limited to International trade but more than that. Yet we focus more on trade. We forget to think that what matters for mankind is the quality and not the quantity. The good qualities that should come with Globalization is fading.

People around the world want to live in peace. They make there life meaningful by making a modest living. People find contentment when they are able to bring their children to school, provide for their families and secure their future financially. This is the dream of every family globally. This dream of every family globally has become a reality for the majority, mostly because of the good economy. But so much has changed and this goal has crumbled down for many during this pandemic. It has placed many economies at the brink of collapse. It has affected trade and commerce across the world. We became very vulnerable to this crisis. This problem is global and common to almost everyone around the world. These can be resolved by a strong will in Global Cooperative Action.

Many find the topic in Economics unappealing. There are many terms to understand such as microeconomics and macroeconomics. Microeconomics or Moicroecon as most students call it helps us understand how an individual affect and contribute to the market which in turn affects the nation’s and world’s economy as a whole. In economics we find out that Consumer decisions would have a great impact on the global market specially on environmental health. We are all consumers, and a great chunk of people, young or old are entrepreneurs. Anyone can also be an Investor. The Purchasing power will keep getting high as many learn the trades of economics and as they enter the workforce.

As we learn and explore more about economics this will help boost the prosperity of a nation. When we are well educated we become more productive which is good for the economy. When our economy is good and prosperous, the people will be healthier and also better educated. Economics is a cycle, and learning about it is a win-win!

There are diverse reasons as to why individuals borrow money, whether it’s loans from Citrus, banks, online lenders or credit unions. A person, for example, could get a loan to fund a deficit, some make use of loans for educational purposes, make hefty purchases, whereas others use it for profit-making investments.

In today’s economic age, loans have turned out to be something relatively important. But the importance of loans isn’t only limited to individuals as governments borrow money as well. This then would mean that borrowing or loans come in different categories and types.

A country could borrow from another country, governments could borrow from individuals, and the other way around. In any case, loaning as well as lending are elemental to a country’s economy.

Loans are used for and in capital investments. These finances that go into capital expenses fuels the activities in a business which lead to the economy’s general growth. There were circumstances wherein governments were forced to significantly spend on revenue expenditures. What is its implication? For instance, an thing of revenue expenditure is funded with loans. This basically means future revenues that are used now, which is rather crucial. It isn’t good thing for a country to compromise its autonomy and independence because of loans.

Governments make use of loans to control or have power over the country’s economy via central banks. There are two ways wherein loans could be utilized in the stabilization of the economy.

Inflation is the condition wherein there is an overall rise in the cost of services as well as goods in the economy resulting to the decline of the consumers’ purchasing power. During periods of inflation, there is so much money circulating going after few services and goods. Inflation occurs when an increase in credit is present which increases the money supply in the economy. Therefore, the costs of commodities also increase which raises the rate of inflation.

To control inflation, the government, via the central bank, will be increasing the rate of interest placed on loans as well as on deposits. Since interest rates are high, individuals can’t loan or borrow. This causes individuals to save money reducing the quantity of money in circulation. amount of money in circulation. Hence, inflation declines.

Inflation isn’t a nice situation to be in. Frequently, consumers suffer because of lessened purchasing power. Does this make deflation a better scenario? Deflation is the reverse of inflation. Prices of services and goods considerably slumps, and this may possibly impact the economy in a negative way.

To control and correct deflation, there is a call for added credit to encourage and fuel investments. As a result, the government, again via the central bank, cuts down the rates of interest place on loans as well as deposits. This then incites consumption or purchasing power of the consumers however limits savings, thus controls deflation.

The impact of loans on the economy could actually be more than inflation and deflation, since the each kind and level of loans or debts influence the economy in different ways.

In the ever-evolving world of economics, staying informed is critical to understanding the dynamic landscape that shapes our financial reality. Amidst this complexity, there are still a lot of people who often encounter situations where accessing funds becomes a challenge. By taking the time to check out different choices offered by the best inheritance loan companies can be a really practical move especially if you are someone who is seeking financial aid.

Some companies provide inheritance loans that allow people to access a part of their inheritance before the probate process ends. Such resources are essential in navigating the economy beyond traditional ideas of supply and demand.

In today’s world, staying updated with the latest global events is essential. For instance, consider how the recent trade war between the U.S. and China has disrupted global supply chains, affecting businesses and consumers. Globalization has created complex interdependent relationships between economies. Staying informed is crucial to navigate the modern global economy.

The current fast-paced world has made it essential to prioritize innovation in driving economic growth. For example, the advent of digital technologies such as blockchain and artificial intelligence has caused a revolution in various industries, resulting in increased productivity and economic development.

Building resilient economies requires the implementation of such technological advancements, promoting an entrepreneurial mindset, and fostering a culture of continuous improvement.

Sustainable business and societal growth are driven by innovation as industries evolve with new ideas and technologies.

It is crucial to deeply understand the various government policies as they play a significant role in shaping the economic landscape. For example, a government’s decision to increase or decrease taxes can directly affect the profitability of businesses and the disposable income of individuals.

The policies created by policymakers, ranging from fiscal measures to regulatory frameworks, directly impact businesses and individuals. Therefore, it is imperative to comprehend these policies thoroughly to make informed decisions and confidently navigate the economic terrain.

The economy is dynamic and constantly evolving, demanding regular attention and a deep understanding. To successfully navigate the complex economic landscape, individuals and businesses need to stay informed about global events, recognize the impact of innovation, and comprehend the role of government policies. With the ever-changing business environment, possessing knowledge about the intricacies of the economy is genuinely empowering and being informed enables us to choose and decide wisely for a successful future.

In the intricate dance between the economy and personal finance, one often overlooked aspect is the profound impact of a robust economic environment on Inheritance Wirehouse and wealth transfer services. This article delves into the symbiotic relationship between a flourishing economy and the facilitation of seamless wealth transitions across generations.

1. Economic Growth and Asset Appreciation: A thriving economy sets the stage for asset growth and appreciation, a fundamental component of any inheritance. Robust financial markets, increasing property values, and a buoyant business environment contribute to the augmentation of family wealth. As these assets appreciate, the potential inheritance value expands, providing a more substantial financial foundation for the next generation.

2. Job Market Stability and Financial Security: A stable job market is a cornerstone of a flourishing economy, directly impacting the financial security of individuals and families. Inheritance planning is not just about monetary assets but also about creating a secure environment for the heirs. A robust economy supports job creation, reduces unemployment rates, and enhances overall financial well-being, thereby fostering a conducive atmosphere for successful wealth transfer.

3. Favorable Tax Policies and Wealth Preservation: Government policies and taxation play a pivotal role in wealth transfer. A thriving economy often leads to policies that encourage investment and wealth preservation. Inheritance tax laws may become more favorable, providing families with the opportunity to pass on their assets without significant financial burdens. This intersection of economic health and legislative support can significantly enhance wealth transfer services.

4. Technological Advancements in Financial Planning: A prospering economy fosters innovation and technological advancements in the financial sector. This translates to more sophisticated tools and platforms for inheritance planning. From digital wills to smart investment strategies, technology empowers families to navigate the complexities of wealth transfer with greater ease and efficiency.

5. Social and Cultural Shifts in Wealth Perception: Economic prosperity often influences societal perceptions of wealth. A positive economic climate can contribute to a more open and collaborative approach to inheritance discussions within families. As financial literacy grows and cultural norms evolve, the stigma around wealth transfer conversations diminishes, fostering healthier and more transparent communication about inheritances.

You might also want to read about Navigating Economic Downturns: Strategies from Property Investment Advisors.

Conclusion: Inheritance prosperity is not solely dependent on individual financial decisions but is intricately linked to the broader economic landscape. A thriving economy creates an environment conducive to the growth and preservation of wealth, positively impacting every aspect of inheritance planning. As we navigate the complexities of wealth transfer services, recognizing and understanding the symbiotic relationship between a robust economy and the facilitation of seamless inheritance becomes paramount for families seeking to build a lasting financial legacy.

Mortgages play a pivotal role in shaping the economic landscape, weaving a complex tapestry that impacts various facets of our financial ecosystem. In this exploration, we delve into the intricate relationship between mortgages and the broader economy, unraveling the threads that connect housing market dynamics, employment trends, and consumer spending. Along the way, we’ll shine a light on the crucial role mortgage brokers play in navigating this intricate web. Wondering how to get a mortgage in Calgary? Talk to your nearest mortgage broker in Calgary now.

Understanding the pulse of prosperity begins with acknowledging the multifaceted nature of mortgages. These financial instruments extend beyond the simple act of home buying; they act as economic indicators, offering insights into the health and vitality of the economy.

The symbiotic dance between mortgages and employment underscores the interconnected nature of these economic elements.

As mortgages shape housing decisions and employment stability, they inevitably influence consumer spending.

Mortgage brokers emerge as maestros in this intricate symphony of economic elements.

READ ALSO: The Significance Of Learning About Economy

In this exploration of the interplay between mortgages and the broader economy, one thing becomes clear—mortgages are not just financial transactions; they are barometers of economic health. Mortgage brokers, with their nuanced understanding of market dynamics, emerge as key players in fostering a harmonious future where economic prosperity pulses steadily.

Payday loans have been a part of the American economy since the early 2000s, providing short-term loans to cover unexpected expenses or bridge the gap until a paycheck arrives. But while they can be beneficial in certain circumstances, payday loans come with high-interest rates and other fees that can make them an expensive choice. This article will explore the economic impact of using 24 hour payday loans open now, as well as how it affects borrowers and lenders alike.

Payday loans have become an increasingly popular form of financial assistance for those in need of quick cash. These loans provide a convenient and fast way to access funds when needed, without having to go through the lengthy process of traditional loan applications. The advantages of payday loans for economic growth are numerous, including lower interest rates, shorter repayment periods, and shorter waiting times for approval.

By providing this type of financial assistance to those who need it most, payday loans can help stimulate economic growth by increasing consumer spending and providing businesses with the capital they need to expand their operations. Additionally, these loans can help those in debt get back on their feet faster by providing them with the funds they need to pay off their debts more quickly. With all these benefits in mind, it’s clear that payday loans are an important part of any country’s economy.

With payday loans, borrowers can access the money they need within hours or days without having to jump through hoops or wait weeks for approval. The pros include easy access to emergency funds and the ability to borrow small amounts over short periods of time with no credit check required. The cons include high fees and interest rates as well as potential debt traps if not used responsibly.

Short-term loans can be a great way to get the capital needed to start or grow a small business. But they come with risks that must be carefully weighed before taking out a loan. The potential financial risks of these loans include high-interest rates, short repayment terms, and inability to pay back the loan. It’s important for small business owners to understand how these loans can affect their cash flow and overall financial stability before making any decisions.

ALSO READ: Study Economics To Analyze Economic News

Payday lending is a potentially dangerous form of borrowing that can have devastating consequences. With high-interest rates and fees, borrowers can quickly find themselves in a cycle of debt that can be difficult to escape from. It is important to understand the risks associated with payday loans before taking them out and to consider alternative options if possible.

Payday loan regulations are vitally important for ensuring consumer protection. The government has put in place a number of initiatives to help protect consumers from excessive fees and high-interest rates, as well as unfair lending practices. These initiatives are designed to ensure that payday loans are available to those who need them, but the terms of these loans remain fair and reasonable so that borrowers can meet their short-term financial needs without falling into long-term debt traps.

The question of whether there is a balance between protecting consumers and promoting economic growth through payday lending is one that has been debated for many years. On the one hand, payday lenders provide an important service to those who need quick access to cash in order to cover unexpected expenses. On the other hand, these lenders can also be predatory and take advantage of vulnerable populations. As such, it is important to ensure that there is a balance between consumer protection and economic growth when it comes to payday lending. This article will discuss the various ways in which this balance can be achieved through regulations, consumer education, and other measures.

You encounter money everywhere in everyday life. When most people think of the word “money”, they first think of coins and banknotes. You talk about “making money” when it comes to your income. You talk about “spending money” when you shop. With larger purchases, it happens that you “borrow money”, i.e. have to take out a loan, be it from a circle of friends or from a bank.

When it comes to forex and crypto, you use the money to trade. You want to earn money as an investor. Thus, you view aaafx review to play an important role when it comes to long-term success in trading.

This very different use of the term “money” is no coincidence. It is an expression of the many functions that money has in economic life.

Money facilitates the exchange of goods and services in modern economies characterized by a high degree of division of labor and specialization.

Without money, there would be a barter economy.

If there were no money, people in societies that have built their economic life on exchange relationships would have to exchange goods directly. You would have to find a person who offers exactly what you are looking for. At the same time, this person would have to need exactly what you want to exchange yourself. If nobody can be found to swap directly, sometimes long chains of swapping would be necessary until everyone gets what they need. In addition, the exchange ratios of each good to each other would have to be laboriously determined.

The generally recognized and accepted “intermediate exchange commodity” money, on the other hand, makes trading easier. The double exchange of “goods for money” and “money for goods” takes the place of the simple exchange of “goods for goods”. With money, the purchase and sale of goods can also differ in terms of time and place. In addition, money is a general measure by which the value of any good can be expressed and easily compared.

Money simplifies economic life considerably because it makes the value of goods comparable via a unit of account. Without money, the individual exchange ratios would have to be determined.

Money plays an essential role in modern economies. It enables trade and supports the division of labor economy.

Entrepreneurship is essential for many reasons from driving innovation to promoting social change. Business people are often seen as national assets that need to be nurtured, motivated and remunerated to the greatest extent possible. In reality, some of the most industrialized countries, like the United States, are world leaders. The reason for this is because of their entrepreneurial people, forward-thinking innovation, and research.

Great entrepreneurs in AC repair in Alexandria, VA business have the ability to change the way you live and work, on a local and national basis. Their innovations can improve living standards. In addition, they to create wealth through entrepreneurial enterprise. Furthermore, they create jobs and contribute to a growing economy. You should not underestimate the importance of AC repair entrepreneurship.

New products and services created by entrepreneurs can have a cascading effect if they stimulate businesses or related sectors that must support the new enterprise, promoting economic development.

Future development efforts in other countries require robust logistical support, capital investment and a skilled workforce. From the highly skilled Ac repairman to the IT experts, entrepreneurship benefits much of the economy. In the US alone, small businesses created 1.6 million net jobs in 2019.

Entrepreneurial ventures help make new wealth. Current businesses may remain confined to existing markets and reach a revenue cap. Improved and new services, products or technology from businesspersons allow the development of new markets and the creation of new wealth.

In addition, higher earnings and increased employment add to national income in the form of higher government spending and higher tax revenues. These revenues can be used by the government to invest in other distressed sectors and in human capital.

By offering unique goods and services, AC repair entrepreneurs break with tradition and reduce reliance on outdated systems and technologies. This can result in greater economic freedom, improved quality of life, and improved morale.

Entrepreneurs frequently encourage the ventures of other like-minded individuals. In addition, they invest in community developments and provide financial support to local charities. This allows for further development beyond their own enterprises.

Some well-known entrepreneurs have used their money to fund good causes, from education to public health. The qualities that make an entrepreneur may be the same qualities that motivate businesspersons to pay it forward through charity in a later chapter of life.