If Governments Do Not Do More, An Economic Depression Will Occur.

Economist Willem Buiter is sounding the alarm. The global economy is heading for depression due to the restrained approach to the corona crisis. “It’s depressing […]

The economy is the backbone of society. It shapes your future and affects your life in more ways than you can imagine.

The economy plays a crucial role in shaping your future, as it affects every aspect of your life. It determines how you allocate and distribute resources. This affects employment opportunities, wages, prices of goods and services, investment opportunities, government policies and regulations, and much more.

It is important to understand the role that the economy plays in shaping your future. This way, you can make informed decisions about how best to use the resources available to you. By understanding how economic forces work together to shape your future, you can make better decisions about where to invest resources for maximum benefit.

Economic policies are essential for growth. For example, countries that maintain open markets for both domestic and international trade are generally more successful than more closed economies where the government actively intervenes in markets.

Political and economic institutions are also determining factors. For example, countries with governments governed by written constitutions, independent judicial systems that enforce contracts, low bureaucratic costs, and economic stability.

Certain structural characteristics also affect growth. Geography affects the costs of trade, the productivity of the labor force, and the returns to agriculture, among other factors.

Payday loans have been a part of the American economy since the early 2000s, providing short-term loans to cover unexpected expenses or bridge the gap until a paycheck arrives. But while they can be beneficial in certain circumstances, payday loans come with high-interest rates and other fees that can make them an expensive choice. This article will explore the economic impact of using 24 hour payday loans open now, as well as how it affects borrowers and lenders alike.

Payday loans have become an increasingly popular form of financial assistance for those in need of quick cash. These loans provide a convenient and fast way to access funds when needed, without having to go through the lengthy process of traditional loan applications. The advantages of payday loans for economic growth are numerous, including lower interest rates, shorter repayment periods, and shorter waiting times for approval.

By providing this type of financial assistance to those who need it most, payday loans can help stimulate economic growth by increasing consumer spending and providing businesses with the capital they need to expand their operations. Additionally, these loans can help those in debt get back on their feet faster by providing them with the funds they need to pay off their debts more quickly. With all these benefits in mind, it’s clear that payday loans are an important part of any country’s economy.

With payday loans, borrowers can access the money they need within hours or days without having to jump through hoops or wait weeks for approval. The pros include easy access to emergency funds and the ability to borrow small amounts over short periods of time with no credit check required. The cons include high fees and interest rates as well as potential debt traps if not used responsibly.

Short-term loans can be a great way to get the capital needed to start or grow a small business. But they come with risks that must be carefully weighed before taking out a loan. The potential financial risks of these loans include high-interest rates, short repayment terms, and inability to pay back the loan. It’s important for small business owners to understand how these loans can affect their cash flow and overall financial stability before making any decisions.

ALSO READ: Study Economics To Analyze Economic News

Payday lending is a potentially dangerous form of borrowing that can have devastating consequences. With high-interest rates and fees, borrowers can quickly find themselves in a cycle of debt that can be difficult to escape from. It is important to understand the risks associated with payday loans before taking them out and to consider alternative options if possible.

Payday loan regulations are vitally important for ensuring consumer protection. The government has put in place a number of initiatives to help protect consumers from excessive fees and high-interest rates, as well as unfair lending practices. These initiatives are designed to ensure that payday loans are available to those who need them, but the terms of these loans remain fair and reasonable so that borrowers can meet their short-term financial needs without falling into long-term debt traps.

The question of whether there is a balance between protecting consumers and promoting economic growth through payday lending is one that has been debated for many years. On the one hand, payday lenders provide an important service to those who need quick access to cash in order to cover unexpected expenses. On the other hand, these lenders can also be predatory and take advantage of vulnerable populations. As such, it is important to ensure that there is a balance between consumer protection and economic growth when it comes to payday lending. This article will discuss the various ways in which this balance can be achieved through regulations, consumer education, and other measures.

Mastering the fundamentals of the economy makes it possible to decipher economic news. You can do this in a more structured way with models and tools to be applied in reasoning. This makes it possible to create links between the different events, points of view, and currents of thought.

Admittedly, economists do not always have enough information to know. You also do not know exactly the world’s oil supply on which you can count or the resources required to eradicate famine.

However, thanks to the knowledge acquired in the field of economics, you can become a better manager.

Knowledge of the economy still makes it possible to be a better citizen. This is especially possible in the context of economic and social crises. Professionals and students in vocational training, for example, can acquire economic reasoning.

You encounter money everywhere in everyday life. When most people think of the word “money”, they first think of coins and banknotes. You talk about “making money” when it comes to your income. You talk about “spending money” when you shop. With larger purchases, it happens that you “borrow money”, i.e. have to take out a loan, be it from a circle of friends or from a bank.

When it comes to forex and crypto, you use the money to trade. You want to earn money as an investor. Thus, you view aaafx review to play an important role when it comes to long-term success in trading.

This very different use of the term “money” is no coincidence. It is an expression of the many functions that money has in economic life.

Money facilitates the exchange of goods and services in modern economies characterized by a high degree of division of labor and specialization.

Without money, there would be a barter economy.

If there were no money, people in societies that have built their economic life on exchange relationships would have to exchange goods directly. You would have to find a person who offers exactly what you are looking for. At the same time, this person would have to need exactly what you want to exchange yourself. If nobody can be found to swap directly, sometimes long chains of swapping would be necessary until everyone gets what they need. In addition, the exchange ratios of each good to each other would have to be laboriously determined.

The generally recognized and accepted “intermediate exchange commodity” money, on the other hand, makes trading easier. The double exchange of “goods for money” and “money for goods” takes the place of the simple exchange of “goods for goods”. With money, the purchase and sale of goods can also differ in terms of time and place. In addition, money is a general measure by which the value of any good can be expressed and easily compared.

Money simplifies economic life considerably because it makes the value of goods comparable via a unit of account. Without money, the individual exchange ratios would have to be determined.

Money plays an essential role in modern economies. It enables trade and supports the division of labor economy.

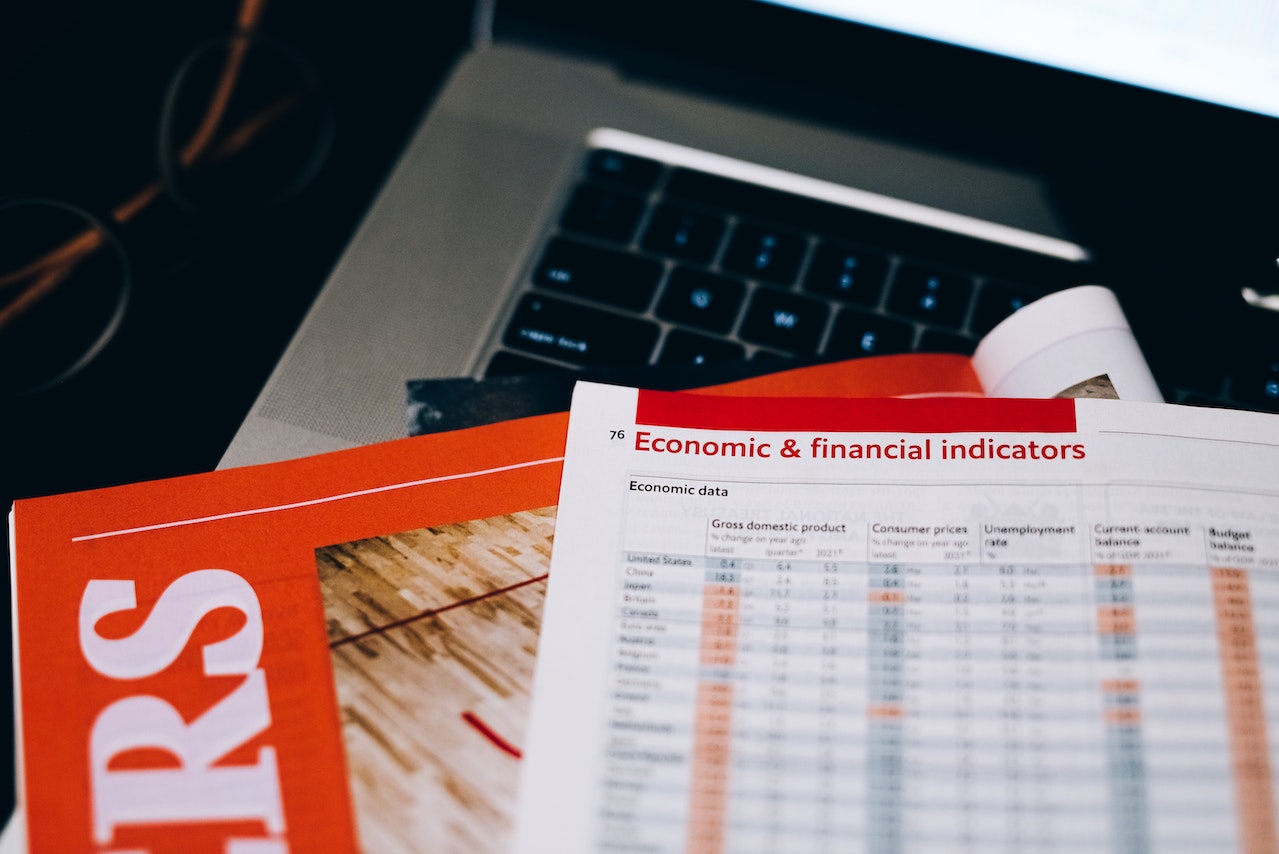

Technically speaking, economic growth means a change in gross domestic product. An example is the sum of the economic goods produced in an economy expressed in values, from one period to the next.

Nominal economic growth defines growth as a monetary change in GDP or gross national income. In the case of real economic growth, you subtract the price increase.

The term economic growth also includes medium- or long-term growth. It is also a trend growth that results if one disregards the temporary seasonal and cyclical fluctuations in economic development. Economic growth in this sense is the subject of theoretical and empirical economic research. It is one of the main goals of economic policy action.

Entrepreneurship is essential for many reasons from driving innovation to promoting social change. Business people are often seen as national assets that need to be nurtured, motivated and remunerated to the greatest extent possible. In reality, some of the most industrialized countries, like the United States, are world leaders. The reason for this is because of their entrepreneurial people, forward-thinking innovation, and research.

Great entrepreneurs in AC repair in Alexandria, VA business have the ability to change the way you live and work, on a local and national basis. Their innovations can improve living standards. In addition, they to create wealth through entrepreneurial enterprise. Furthermore, they create jobs and contribute to a growing economy. You should not underestimate the importance of AC repair entrepreneurship.

New products and services created by entrepreneurs can have a cascading effect if they stimulate businesses or related sectors that must support the new enterprise, promoting economic development.

Future development efforts in other countries require robust logistical support, capital investment and a skilled workforce. From the highly skilled Ac repairman to the IT experts, entrepreneurship benefits much of the economy. In the US alone, small businesses created 1.6 million net jobs in 2019.

Entrepreneurial ventures help make new wealth. Current businesses may remain confined to existing markets and reach a revenue cap. Improved and new services, products or technology from businesspersons allow the development of new markets and the creation of new wealth.

In addition, higher earnings and increased employment add to national income in the form of higher government spending and higher tax revenues. These revenues can be used by the government to invest in other distressed sectors and in human capital.

By offering unique goods and services, AC repair entrepreneurs break with tradition and reduce reliance on outdated systems and technologies. This can result in greater economic freedom, improved quality of life, and improved morale.

Entrepreneurs frequently encourage the ventures of other like-minded individuals. In addition, they invest in community developments and provide financial support to local charities. This allows for further development beyond their own enterprises.

Some well-known entrepreneurs have used their money to fund good causes, from education to public health. The qualities that make an entrepreneur may be the same qualities that motivate businesspersons to pay it forward through charity in a later chapter of life.

The economic principle includes the economical use of scarce resources. Management is necessary because the goods to satisfy needs are limited, but needs are practically unlimited. The “economic principle” demands that scarce goods be used in such a way that the best possible relationship between the satisfaction of needs and the consumption of goods is achieved.

The principle of economic efficiency and the level of costs are loosely related. The obligation to act economically does not mean that the cheapest offer always has to be chosen. The cheapest is not always the cheapest and therefore the most economical. Aspects such as reliability, durability or special regional conditions can influence the decision.

The economic principle states that the best possible relationship between expenditure and income must be achieved.

Bitcoin is a digital currency that was launched in 2009 as a revolutionary financial tool intended to eliminate the vulnerabilities of fiat currencies and traditional banking systems.

It is decentralized and was developed as an alternative for cheaper and faster money transfers. Bitcoin has quickly become one of the most valuable financial assets on the market. Still, most people agree that bitcoin is good for the economy.

The success of bitcoin has impacted the emergence of several cryptocurrencies that operate on the bitcoin model and technology. This has created an entire cryptocurrency industry with vast reserves held by institutions and individuals around the world.

Bitcoin’s outstanding performance has also fueled its global demand, creating opportunities for cryptocurrency miners, currency exchange companies, forex trading platforms, and investors. Bitcoin is expected to create more chances for economic development as it becomes more widespread in the mainstream sectors.

Bitcoin offers positive effect to the economy because it supports numerous financial transactions just like fiat currencies. Although some countries have excluded bitcoin, countless countries around the world accept bitcoin as a store of value and medium of exchange. Today, several large, medium, and small businesses accept bitcoin as a form of payment.

This means people can use Bitcoin to buy goods and services. People can use bitcoin 360 AI to acquire investments globally. In addition, you can use bitcoin on forex trading like other financial instruments.

Globally, more than a third of the adult population does not have banking facilities and services to turn to in the event of a financial crisis. This denies them access to credit and other essential financial support, further fueling economic turmoil.

Bitcoin offers these financially disadvantaged populations excellent opportunities for easier access to capital.

Bitcoin is a decentralized currency that allows individuals and businesses to exchange money without restrictions across international borders. This means that even people without a bank account can easily send and receive money for private and business use.

Most people, especially in developing countries, are reluctant to invest because of the bureaucracy and corruption in traditional financial systems. Although bitcoin cannot eliminate corruption and bureaucracy, it offers its users better protection against such risks.

That’s because bitcoin transactions are encrypted in blocks of data and digitized that only users have access to.

The transparency of Bitcoin transactions greatly reduces the risk of financial crimes such as corruption and fraud. This enables individuals and companies in developing countries to participate in global financial transactions, thereby improving their economic and social standards.

Did you know local small businesses such as towing services improve your life every day? Without small businesses, you would be missing out on a ton of amazing benefits.

Small companies may be limited in size, but their importance to developed and developing economies is enormous. According to the World Trade Organization, small and medium-sized enterprises in developed countries account for over 90% of the business population, 60-70% of jobs and 55% of GDP. When you support a small business like Towing Service San Jose, you also support the local community in which it is based. Spending your money there will help stimulate the local economy. Find local towing business in San Jose, California. Find them on the map – https://maps.app.goo.gl/HgmB8MtTgA12xBRm7.

Small, micro, and medium-sized businesses are accountable for more than two-thirds of all jobs globally. In addition, they account for most of the newly created jobs.

Not only do local businesses help community members with more job opportunities, but they also support other local businesses. By sourcing materials for their own business locally, more of the money stays in their community.

Small businesses also play part to the distinctiveness of the local community in which they operate. Since many small entrepreneurs are very appreciative of community support, they are often happy to reciprocate by attending community events and donating to local charities. It is about being an active member of the community and improving the community on different levels.

Small businesses have the greatest impact on local communities by enriching your neighborhoods with their unique products and services. Most small businesses are run by people and not by boards or interest groups. They reflect the personality of the owner.

Because many small businesses must compete with bigger establishments, they are continually working to offer new products and services and bring new benefits to their customers. This encourages small businesses to innovate and offer unique products to keep customers coming back.

At the same time, smaller companies are more quickly able to keep up with changing customer demands. Therefore, it is often independent, small companies that are innovative and create and offer new opportunities.

Starting your own household, the long-awaited self-determination, is the first big step towards independence from your parents’ home. However, this usually entails financial restrictions for young adults, which in the worst case can result in over-indebtedness. However, housekeeping as an economic principle is not limited to the private sphere. It also represents a basic condition for the actions of all economic actors at the various levels of market economy systems.

In general, households are understood to be planned activities with the aim of making the best possible use of scarce resources or economic goods. Housekeeping is a constant underlying all economic actions of the actors and their relationships.

As a rule, private households obtain their income from different sources. These are remuneration for self-employed or dependent work, assets and state transfers. They make their income allocation decisions in the field of tension between unlimited needs and limited resources. Within the framework of decisions concerning the use of income, private households have the two options “consumption” and “capital formation”.

Within market economy order systems, company foundations and entrepreneurial activities are primarily concerned with generating profits. The ecological and social objectives are also becoming increasingly important over the course of the decades.

Public tasks are financed primarily through public taxes. Tasks of the state at federal, state and municipal level exceed the available income. The budgetary policy discussions and decisions at all levels are characterized by strong controversies as well as conflicts of parties and interests.

Housekeeping as an economic principle cannot be limited to the private sphere, but is also at home in many different areas of the market economy. Companies, states and private homes can take advantage of the best budget planner to manage their finances.

At its core, budgeting refers to any kind of planned activity with the aim of making the best possible use of scarce resources or economic goods. This means that housekeeping takes place on a small and large scale. It is a constant underlying all economic actions of actors and their relationships. This includes individuals and private households as well as business enterprises and nation states.

One of the main goals of national economic policy everywhere in the globe is economic growth. This creates jobs, solves social conflicts and facilitates structural change. Because of growth in the economy, government can invest more money in development aid and environment protection.

Economic growth means that an economy produces more and better goods and services than in the past. Economic growth is particularly important when these goods and services lead to an increase in the standard of living of broad sections of the population. In other words, everyone should benefit from economic growth. History shows that economic growth has indeed lifted many people out of poverty, disease, or unemployment. In addition, of course, economic growth also helps to finance the welfare state.

The mere thought that at any time, at any hour you may be hit by a totally unforeseen economic crisis can keep you awake at night, wracked with worry.

Cash accounts will help you the most if you happen to be in a financial crisis. These accounts are:

In order to create some kind of safety net in the event of unforeseen situations, it would be best to include such instruments in the investment portfolio.

If you don’t know exactly how much money you take in and how much you need each month to survive, then you won’t know how to properly estimate your safety fund.

That’s exactly why almost all financial analysts and accountants advise you to know exactly how you are doing from a financial point of view.

Trying to lower your monthly bills is one thing, not paying them is another matter entirely.

Absolutely any obligation must be paid in a timely manner. Otherwise, you risk that others will be added to the already existing amounts, in the form of penalty fees or commissions.

Basically, you are doing nothing but increasing your expenses.

If you have a RTA cabinets business loan in progress, try to pay them off as quickly as you can.

By paying all your loans in time, you will get rid of their worries, so you will be calm if something unexpected happens.

It would be ideal for any business owner to have as many relationships and knowledge as possible. The more the better.

That way, when unexpected situations come your way, you’ll have someone to turn to. Besides, references from someone you know are much better for any business. To ensure your comfort and monetary security for your business, make as many connections as possible. You can also use social network platforms to advertise and make your business known.

Implementing an SEO campaign can be a daunting task for small businesses. With so many articles explaining SEO tips and tricks, it can quickly become overwhelming.

Implementing an SEO campaign can be a daunting task for small businesses. With so many articles explaining SEO tips and tricks, it can quickly become overwhelming.

Your website’s design can significantly impact whether you rank in search engines, directly or indirectly. Considering your website’s structure before you start, you can strategically plan how to drive traffic to your website. First, we need to consider these page structure elements. You should consider hierarchy, the easiest way to code your site, and what menu navigation works best for your site.

There are countless keyword research tools, but Google’s Keyword Planner is the most widely used and easiest to use. Use this tool to research the search volume of specific keywords you want to target.

You can compare search traffic to determine which keywords are most profitable. You can also use Keyword Planner to generate new keywords related to your topic.

While writing blogs shouldn’t be done solely for SEO, blogging offers several SEO benefits besides providing exciting and relevant content to your audience. Creating a blog will improve your marketing efforts:

Content is how you become a more significant business, but creating an ideal user experience helps level things out. Find what to look out for and areas that could be improved. One crucial area that many small businesses fail to understand is that content should read naturally. You shouldn’t include excessive keywords that will help you rank; instead, you should include them where they are relevant and add value to your audience.

First, create an account with Google Search Console and Bing Webmaster Tools. Once everything is set up, submit your sitemap. Once created, specify the location in the robots.txt file. Submitting your sitemap to Google and Bing ensures that your site is indexed correctly. It isn’t the only reason you should create an account with Google Search Console and Bing Webmaster Tools.

SEO agency in Phoenix is a way to improve traffic and sales, provide better customer service, increase the profitability of existing customers and even improve a business’s public image. It takes time to do it right, and so many small-business owners find themselves too busy with other things to take care of it. The good news is that many companies in the know can handle this tricky task for local businesses.

Insurance is a key component of highly developed economies. Economic activity and growth are only made possible by hedging against risks.

The insurance industry is one of the few sectors in an economy whose performance is of great importance to practically the entire economy. Thus, the insurance industry is thus fundamentally comparable to banks or the energy sector.

It assumes insurable risks for the entire economy and thereby supports economic activity and innovation.

Risks are ultimately hidden costs. The pricing of insurable risks within the framework of insurance contracts makes the costs of alternative courses of action clear. In this way, companies and politicians can make well-founded decisions, avoid costs and make better use of their resources. With life insurance, companies not only benefit from this but the employees as well.

Identifying risks is one of the core competencies of the insurance industry. Insurers have extensive risk information systems for this purpose, for example on natural disasters, which are often also made available to the public. As “risk communicators”, they play an important role in forming public opinion, for example with regard to climate change.

In addition to the domestic economy, foreign trade also benefits. Efficient insurance solutions are a prerequisite for companies being so heavily involved internationally.

Not all risks are insurable. The extent to which private insurance cover is offered depends primarily on the respective risks. A risk must be “calculable” so that it can be insured. But the legal framework is also important here, for example the supervisory system.

With ever more complex economic relationships and new technological advances, modern economies are becoming more vulnerable. A current example are so-called cyber risks. Viruses, Trojans and other malicious software or targeted hacker attacks can significantly disrupt operational processes. Industrial espionage can be carried out and copyrights can be violated. These risks change quickly and are therefore difficult to calculate. The limits of insurability become clear here.

The new risk landscape entails major challenges for everyone involved, insurers, business, but also the state and society. These risks can only be managed through a whole bundle of measures from extended insurance cover to new laws and requirements through to extensive damage prevention measures. This is where the insurance industry is particularly challenged. Innovative insurance models must be developed even more than before, especially in the borderline area of insurability. This way, you can achieve economic growth through the insurance industry.

There is an ambivalent interrelationship between the economy and the environment.

On the one hand, the natural environment is the basis of all life and business. It provides resources, absorbs waste products and provides living space. A modern society at today’s level of prosperity would be unthinkable without the natural foundations.

However, raw materials such as crude oil, ores, fresh water or land are not available in unlimited quantities. Biodiversity is threatened and therefore finite. And the atmosphere and ecosystems can only absorb carbon dioxide and pollutants to a certain extent.

On the other hand, an efficient economy and a high level of prosperity are the basis for improved environmental protection and sustainable development. After all, dynamic, market-based economies are better able than stagnant economies to produce environmentally friendly innovations.

So-called “Non Fungible Tokens” are set to revolutionize the digital art market. But insiders and fraudsters in particular benefit from the new technology.

If parties can take place again in the spring, you should prepare yourself for small talk with three letters: NFT.

Non-fungible tokens – non-exchangeable virtual coins – are the digital hype that has pushed its close relatives, the cryptocurrencies, out of the media attention cycle. In 2021, an NFT billion-dollar market emerged out of nowhere with the help of NFT influencers. But at best, NFTs are a mirage, at worst a pyramid scheme.

An NFT is intended to be a digital proof of uniqueness, a certificate of originality. Because the digital has it in itself that practically all data can be easily copied without loss of quality. If everything can be copied infinitely, however, the question of ownership quickly arises. For two decades, music labels and film studios fought their way through people who downloaded songs and films and didn’t see that they were “stealing”. NFTs should rule out such misunderstandings: property on the net should be clearly assigned.

Blockchain technology is intended to make this possible: A blockchain is unchangeable, an – unofficial – digital land register, in it lies the token, immovable and cannot be deleted. It refers to another file on the net – such as a digital image. The idea has something: Artists who create their works purely digitally on the computer make money when they sell NFTs of their pictures or animations. You can’t sell prints in the art trade or at exhibitions. Celebrities such as Paris Hilton or rapper Snoop Dogg promote the technique, as does an army of NFT believers online.

You can see NFTs as a parody of social media capitalism: someone says that this square meter of air is valuable, and has the price driven up by mini, medium, and mega-influencers. Some stupid person – or someone with as much humor as money – then buys the whole thing. And the whole world thinks that values are being created here. Or as a parody of the art market, which has long been accused of being an outbidding competition of the super-rich.

ALSO READ: The Effects of Recessions on the Real Estate Market

But the matter is more serious than that, it is about an extension of financialization to digital “objects”, since everything in the physical world can already be made a commodity. Even image pixels are now supposed to be objects of speculation.

There are even a handful of nice applications like digital trading cards for basketball players. And it is to be hoped that digital artists will find sources of income. But NFTs is a shaky concept for this. Because an NFT is little more than a link to an image on the net. Anyone can create an NFT from a link to the online version of this article with just a few clicks and a bit of cryptocurrency.

However, most NFT fans are not attracted by the supposedly clever technology anyway, but by the promise to get rich quickly by auctioning off a picture as an NFT. Unfortunately, the ecosystem is not only incredibly power-intensive because it uses cryptocurrencies but is also contaminated by fraud. Countless are only the so-called rug pulls of the past year – the proverbial carpet is pulled away from under the feet of investors: Unknowns award tokens on cheaply produced pictures, sell them to gullible people, and disappear. Last year, an analysis showed that a small circle of insiders who were allowed to buy such tokens early on benefited from all sales.

The more unclear the benefits, the louder the rhetoric of revolution: freedom, decentralization, and liberation from the yoke of any institutions. But the auction sites are already the new platforms that, according to crypto logic, should not actually exist at all. If you buy too expensive, you have to see how you can still sell the NFTs on secondary markets, such as pyramid schemes. Thus, the alleged revolution only rescinds the worst sides of the financial and art markets: insider trading, pump-and-dump tricks, fantasy prices, and bubble formation – this was shown by the dramatic NFT price crash last summer.

The smart investments are once again made by the professionals. For example, the investment firms Sequoia and KKR do not invest in NFTs themselves, but through acquisitions in auction and gaming platforms for NFTs. So they earn from the hype without sitting on a bunch of worthless links at the end.

Maybe you simply can’t create a uniqueness on the Internet – and that’s a good thing. After all, the strengths of the network are copying, sharing, and cooperation. And not the pursuit of even more things to own.

You can express the change in the gross domestic product of an economy in terms of economic growth. Thus, it can be both negative and positive.

The great importance of economic growth in a national economy is omnipresent. You may encounter the term economic growth almost every day in daily newspapers or news formats. The development of jobs, tax revenues of the state and thus also of the social security funds are directly related to the growth of the economy.

This represents the increase in the gross domestic product of an economy. It indicates the value of all goods and services that an economy generates often related to one year.

Economic growth, in turn, is reflected in the rate of change in real gross domestic product.

The reason for the increase in performance, i.e. for economic growth, can be better utilization of production capacities.

Are you aware that economic growth resources are directly related? If people provide products or services, they require resources. At least, some of which are non-renewable raw materials. This is counteracted by increases in efficiency, through which the same GDP can be generated with fewer resources. As a result, resource efficiency can increase and the economy can grow.

One of the main goals of national economic policy almost everywhere in the world is economic growth. Arguably, growth raises the population’s standard of living and creates jobs. It can also help solve social conflicts better and enables structural change. Eventually, it is possible to spend more money on activities such as development aid and environmental protection.

Entrepreneurs can transform the way you live and work. If they are successful, their revolutions can improve your standard of living. In short, they not only create wealth from their entrepreneurial ventures but also create jobs and the conditions for a thriving society.

Entrepreneurial ventures literally create new wealth. Society can limit existing businesses to the scope of existing markets and reach the glass ceiling in terms of income. Entrepreneurs’ new and improved offerings, products or technologies enable the opening of new markets. Also, they can help create new wealth.

Economic conditions affect all businesses. But, small businesses often feel the effects of economic change quicker than their larger counterparts. Growth typically provides opportunities for new business start-ups or business expansions. A downward economic progression can have a lasting and severe impact.

In a strong economy, almost every type of business enjoys prosperity. Income is high and unemployment is low. Consumer confidence causes them to invest their money. They check now goods and services, purchase them which they may or may not need, and back in the economy.

The impact of a strong economy on small businesses is twofold. As the business grows, it needs a small business to keep up with demand, by hiring additional people, expanding retail space or by adding new product lines. While some see this as a positive, the opposite is the shaking of the economy, which makes small businesses overexposed, leading to mass layoffs and business failures.

During the downturn, many small businesses are facing a number of changes. Consumers become worried about job stability and become wary of spending. This leads to a decrease in the income of business owners. A slow profit can be difficult for a small business in the process of repaying creditors, thus having a negative impact on its long-term viability.

A financially struggling business is much less likely to borrow for capital expenditures and operations, which limits growth opportunities. Many small businesses are forced to lessen their labor force during a slow economy. Because of this, it limits their ability to serve customers. It can impact their ability to contribute to the unemployment rate. This leads to a slowdown in the economy.

Some kinds of small businesses prosper in a slow economy. For example, companies that are involved in facilitating the foreclosure of real estate and vehicle and property restitution find success during a slow economy. In addition, small business owners with strong and substantial financial support may see an increase in expansion opportunities. They can do this by buying their distressed competitors or by absorbing competitors’ customer bases outside the business.

The main function of the economy is to explain facts and phenomena related to the production, exchange and consumption of goods and services. It studies the behaviour of organizations and individuals involved in economic activities. It also studies the reasons that lead them to carry out these activities.

Economics formulates laws and principles that people use not only to explain but also to predict the occurrence of economic facts and phenomena and to influence their development.

Explain economic facts and phenomena;

Predicts the production of economic facts and phenomena;

Proposes ways to influence the way economic facts and phenomena unfold.

The current economy undermines your prosperity because it destroys the natural basis of economic activity. Therefore, the transition to a green economy that is in harmony with nature and the environment is necessary.

Green Economy is a new model for economic development. It combines ecology and economy in a positive way and thereby increases social welfare. The goal is an economy that is in unison with the environment and nature. The transition to a green economy needs a comprehensive ecological modernization of the entire economy. In particular, you must change resource consumption, emission reduction, product design and the conversion of value chains. The promotion of environmental innovations is of central importance.

Economist Willem Buiter is sounding the alarm. The global economy is heading for depression due to the restrained approach to the corona crisis. “It’s depressing how politicians let us down.” Taboos have to give way, even if they cause the inflation specter to rear its head again.’ If you are interested visit this site dog bite lawyers.

‘Governments must support the demand. Some countries have already done something, such as credit guarantees to prevent companies from going bankrupt. But it remains insufficient. Certainly in the eurozone, the promised budgetary stimulus with barely 1 percent of gross domestic product (GDP) is very poor. A hard-hit country like Italy needs a stimulus of at least 5 percent of GDP, while it doesn’t have the space for it. That is why Europe urgently needs to support its weaker economies, through the European Central Bank (ECB) or the European emergency fund ESM. It’s depressing how politics is letting us down.’

Buiter: ‘Every day lost is one too many as economic demand evaporates due to the lockdown, with companies and families seeing their incomes disappear. Every day lost is a loss of production and demand.’

Buiter: ‘The central banks have to finance the budget deficits by buying up the new government debt securities with money they create out of thin air ( ‘monetizing debt, ed. ). Some countries have fiscal space, such as Germany and the Netherlands, many others do not. You have to help them, either through the ESM fund, which has to get considerably more resources or by letting the ECB buy up debt.’

Buiter: ‘The ECB has already done this indirectly in recent years through its purchase program for existing debt securities. Now there will be a clearer question of monetization of debt. We will have to live with that. Europe will have to rewrite its treaties or interpret the texts flexibly.’

“We must also resign ourselves to a return of high inflation, one that is higher than we want. Against a strong demand stimulus, there is a lack of measures to strengthen the supply side, an imbalance that pushes up the price level. By the end of the year, we are likely to see an inflation spike. We don’t have to worry about that right away. These are exceptional times and circumstances. Inflation is a small price compared to the alternative of depression.’

Buiter: ‘Their action is important because it stabilizes the markets. More importantly, they have the fiscal authorities ( governments, ed. ) To give the message that there is no limit to monetary support, no limit on debt. A kind of free helicopter money from the central banks. That is positive news.’

Buiter: ‘The violent reaction is not surprising. We have an economic disaster that could turn into a financial disaster if governments don’t do everything they can to prevent the financial markets from imploding. Due to the magnitude of the crisis, banks will come under pressure, through bad credit or losses on the bonds in their portfolios. The central banks must therefore stand by and help the banks in their task to keep the companies afloat. This is a crisis in the real economy that could spill over into the financial system.’

Buiter: ‘I fear the nationalist and anti-globalist reflexes of the policymakers. It makes sense to diversify the international supply chains of companies. But that is different from pure economic nationalism with the aim of reducing dependence on Asia – China in particular – and producing as much as possible itself. That is inefficient and unnecessarily expensive. Moreover, not only the supply line with China is disrupted, but also domestic lines if people can no longer work.’

In recent years, the term circular economy became extremely popular. People see this as an answer to the worldwide environmental crisis that is affecting the whole world.

As the name suggests, this form of the economy requires a nonstop system of production. It requires the reuse of resources and wastes that many fields can use. There are already initiatives in this regard, albeit only on a small or medium scale.

The purpose of the circular economy is to barge in the classic sequence of production– raw materials – processing – consumption – waste. Specifically, it aims to take the waste and put it back into production. Thus, the cycle looks something like this: raw materials – processing – consumption – reuse of waste in production. And then the process starts from scratch.

For many years the United States Government encouraged American businesses to sell their products overseas. However, for the recent years America is buying more goods than they sell t other countries.

Moving further here are some vocabulary we should first understand, import is buy goods from other countries and export, is to sell goods to other countries. A trade deficit occurs when you import more goods to other countries than you export. Trade agreements are made when countries when the government encourages trade between their countries. A trade agreement is just what it sounds like. It is an agreement among two or more countries that increases trade by making it more beneficial for both parties. But when they want to discourage trade among their countries, a trade barrier is formed. This is an obstacle to trade between two or more nations. A good example of a trade barrier is tariff or a tax on imported goods. Tariff make it more expensive to buy or sell imported products and therefore discourage trade.

We have what is called a traditional economy which involves hunting and gathering, basic sustenance farming, herding cattle etc. This type of economy is in very short supply in today’s world. The two basic forms of modern economy are the market economy or capitalism in which a free exchange of goods happens with the government intervention. We also have the planned economy in which the Government has total control over the means of distribution, such as Communism and Socialism. Most economies are mixed economy which is a combination of planned and market economy. Planned and Market economy is not complex. In every situation, if you have something that is scarce, you have to figure out a way of distributing this resource. Scarcity exists when not enough of a commodity is available to satisfy all of the wants at a zero price. When this happens economies usually ration. This is a way of rationing resources. A rationing system is just a way of distributing or who gets what. In the free market prices indicate this. In the planned economy it will be the Government to decide.

We as humans are incredible in creating and inventing things. We are seriously skilled and talented and we continue to becoming better. As we do so, there is an opportunity to redesign and rethink on how we create things. Can we design products that is made and can be made again? And can we power the whole system with renewable energy? Can our innovation and creativity build an economy that can restore and regenerate? The answer is Circular Economy. This replaces the traditional linear model in which we dig stuff out of the ground, turn it into something, consume it and then put it back to the ground as trash. There are many issues that we should address to have a more sustainable future. Each of us have the potential to help achieve this. Here are a few things we can do to practice circular economy to achieve a sustainable future.

The forex (foreign exchange) market is among the largest financial markets in the globe. It experiences massive quantities of trade on a day-to-day basis. The forex market works similarly as the stock market, however instead of trading stocks, the commodity of exchange is currency. Traders and investors earn profits from the difference between the currency’s exchange rates. A lot of investors find the forex market to be a good place to make an investment.

The forex (foreign exchange) market is among the largest financial markets in the globe. It experiences massive quantities of trade on a day-to-day basis. The forex market works similarly as the stock market, however instead of trading stocks, the commodity of exchange is currency. Traders and investors earn profits from the difference between the currency’s exchange rates. A lot of investors find the forex market to be a good place to make an investment.

If you are considering to trade in the forex market, you will need to hire a reliable forex broker to assist you with this as well as for you to be given access to the forex market through their forex trading platform. FinMarket is one. This online brokerage firm is owned by K-DNA Financial Services Ltd. It is authorized as well as regulated by Cyprus Securities and Exchange Commission or CySEC, which means that the firm is legitimate. To find out more, check out

With regards to the exchange rates, they are affected by the economic status or health of a country. The correlation and interdependence of the currency trading and the economy is then a crucial element of the forex exchange market. On the other hand, there are also factors in foreign exchange to take into consideration when the effects of forex on the economy is analyzed. Let’s have a look into the characteristics of the forex market as well as its impact on the economy.

Major Sectors of the Forex Market

Major Sectors of the Forex MarketThere are two key sectors in the foreign exchange market – the retail sector and the institutional sector. Basically, the retail sector consists of separate small-scale traders. This sector doesn’t majorly affect the economy unlike the institutional market where it has some major impacts on the economy. The institutional market is made up of huge financial players shaping the economy. These institutions do the lending and therefore affects businesses within the economy. For the economy to thrive, it would rely on the forces of demand and supply at the institutional sector. Although the economy isn’t directly influenced by this sector of the market, the upshots of trading within the market could be felt and experienced in the economy.

The foreign exchange market is the only market responsible for making possible international trade. With currency exchange, institutions are enabled to do business past the nation’s borders. Similar to other markets, there is more value in a strong currency and is capable of dominating the global trading market. Furthermore, trader activities in the foreign exchange market have an effect on its prosperity. Uncertainties in the forex market will cause speculators to make price adjustments. This then affects the traders’ profit margins.

News of this UK diving into a second downturn hit the headlines this afternoon. Even though this will not have surprised anybody who has not been hiding in a cave for the past six weeks, the simple fact it is currently official will nevertheless be disconcerting to some.

As most of you may undoubtedly be wondering exactly what type of recession means of the home market and home prices, we chose to collect a post putting out a couple of principles from a real estate perspective. Before we get into that, however, let us have a grip on the significance of a recession.

Entering a downturn signifies the market, a nation’s GDP (Gross Domestic Product), has dropped for 2 successive quarters – i.e. six months in a row.

Entering a recession is not necessarily bad for everyone, rather all recessions are made equal.

The previous downturn, commonly known as the excellent Recession of 2008-09, lasted for five quarters and has been the worst downturn since World War II. It has caused was connected to this US subprime mortgage catastrophe hitting on the British banking industry, however many UK homeowners really profited from falling mortgage obligations, leaving them more disposable income compared to if the market was rising.

Evidently, things were not rosy for everybody, and that is 1 thing each downturn ever has needed: polarisation. Recessions normally result in increased fiscal inequality, together with job reductions, fewer promotions, and pay prices hitting on the average Joe and Joanne difficult.

The 2020 downturn will undoubtedly have loads of nuance for this, thanks mostly to the unprecedented character of its principal cause, specifically coronavirus (COVID-19). The home market, nevertheless, is still composed of four important classes: Privately owned houses; council conduct leasing lodging; leases possessed by private landlords; and housing association properties.

When these categories vary considerably in their cosmetics, the simple fact they are all determined by the general financial health of the nation remains. Additionally, the market can also be marginally pushed by the well-being of the UK’s house market, since it generally reflects the prosperity of the nation and is a catalyst of associated sectors, such as building, such as.

Concerning the direct query, How can a recession affect home rates? , there is no doubt an economic recession may have a negative influence on value. Nevertheless, it is not a blanket statement that is suitable for everywhere, since there are several factors at play.

Popular places, like our stomping floor, Wanstead at East London, will see need driving them ahead, although less desirable localities will fight. Even though the most populous places may nevertheless be struck by a longstanding downturn, its effect is very likely to be dramatic.

At the moment, the unbelievable curiosity about transferring house because lockdown was raised has led to a remarkably balanced market with sufficient supply to fulfill the requirement. The essential question, then, will be the need to continue using all the official statements of the UK entering a downturn, or can people’s land desire begin to wane over the forthcoming months?

Should the latter occur, we might be taking a look at the very first real purchaser’s marketplace because the 90s.

ALSO READ: Education is a Good Foundation To a Strong Economy

This type of question frequently advantages from reframing. Rather than asking whether you ought to purchase a home in a recession, then inquire whether you want to obtain a property at this time. For many, it is going to be a pleasant “yes” others are going to be at the camp, even though a fantastic percentage will probably wonder why they requested in the first location!

Simply speaking, if you’re purchasing on, then a recession issues less than folks believe. For first-time buyers, but things could be slightly more difficult and you will gain from sitting tight and viewing exactly how the market performs during the upcoming few weeks.

One other important factor is equilibrium from an individual financial perspective. Have you got the vital savings? Is the job looking safe for the near future? While not one of us has the advantage of a crystal ball, dismissing these variables completely is foolhardy to say the very least.

Banks, too, will look more carefully in your position, and financing will tighten as we proceed farther into recession. A deepening recession may cause the chancellor to declare an expected reduction on earnings multiples provided by banks to limit borrowing present so as to protect against a great deal of frustration for individuals in the future.

For people that are wondering if you need to sell property in a recession, then the very exact rules apply: would you want to market? We’ve spoken a great deal about ‘need-to-moves’ throughout the previous few years throughout the Brexit discussion, and also a similar train of thought could be applied to promoting your home in a recession: should you have to move, proceed. If you do not, do not.

Affordability comes into play when purchasing as far as it will when purchasing. Selling home prices nevertheless have to be fulfilled, not, and that means you need to ensure moving house will be in your financial comfort zone until you move.

The home market will continue whether or not you input it not, so it is a lot more important to check over your personal situation instead of attempting to second guess what is likely to happen next concerning price changes. And if you need help selling your house in trying times, check out Sell House Fast UK: Quick Home Sale In 7 Days | TPBC to help you out.

There are many factors that causes economic recession or depression. The most common reason for economic reason is mostly political, the Government and its Central Bank decide to stimulate the economy. The GDP of a country can shrink drastically. This means the output and wealth of its country is also shrinking. If this pattern last for 6 months, then we can consider it a recession. If it last longer than 6 months, and becomes severe then it is termed as a Depression.

The Government can try to minimize recession and stimulate growth through the following policies:

All these actions goal is to aim to increase money supply so that consumers and businesses can borrow more easily and consume and invest even more. Most government target an increase in money faster than the rate of growth which can cause inflation or the rise of prices. A small amount of inflation is seen as a good thing and can be an insurance against recession. However, if Governments are too aggressive in increasing the money supply the rate of inflation increases dramatically causing hyperinflation which can be devastating in economic growth.

Productivity directly impacts the economy. It is defined as the measurement of the efficiency of the production process. It is the relationship between inputs and outputs. This can be applied to the individual factors of production.

Labour Production. This is the most widely used measure and is usually calculated by dividing the total output by the number of workers or the number of hours worked.

Total factor productivity attempts to measure the overall productivity of the inputs used by a firm or a country. The quality of different inputs can change significantly over time. There can also be significant differences in the mix of inputs thus firms and other countries may use different definitions in their inputs especially on capital. The difference in living standards will greatly reflect differences in their productivity. The higher productivity in a country is good for its economy.

Gig is a slang term meaning a job for a specified number of time. This term is often used by bands for a one off musical performance. This word has found its way on the mainstream business vocabulary as more communities nowadays trend to the Gig economy.

A Gig Economy is defined as a free market system in which temporary positions are common. Some good examples of this are Freelancers, Independent contractors, project-based workers and temporary hires. They are also called “Gig Workers.” They are commonly found in many industries. They can be writers, ride share drivers, photographers, accountants, realtors, handy man, tutors or anyone who enters into a formal agreement with a company to provide services without being in the company’s payroll. With the digitization, the workplace now is becoming more mobile. Many employees now can find many jobs across the world and employers can find the best individuals for a job without as much geographic strain. The Gig Economy also saves business resources like benefits, office space, and training while providing employees benefits like the freedom to select jobs or gigs that they are interested in. While this flexibility is appealing, gig workers trade this for little or modest pay, little or no health benefits or retirement benefits.

The market economy as a basic form of economic order characterizes an economy that regulates itself through the market. It results from the interplay of supply and demand.

At the end of the 18th century, economists founded the market economy. They called it a system that converts individual selfishness into a social benefit. The principle of the market with its regulation by supply and demand was recognized. In the classical model of the market economy, the greatest prosperity for society is achieved by practicing economic behavior through and complete competition.

The classic theory of the market economy is closely linked to the social theory of liberalism. Liberalism is a school of thought and a way of life that advocates autonomy, responsibility and free development of the personality.

On the other hand, learn how a bitcoin mixer can help with your economic needs.

Private ownership of the means of production is an essential feature of the market economy. Entrepreneurs who own the means of production or rights of disposal are also called “capitalists”. You decide on the production method. The individual plans are regulated by the market, which represents the meeting of supply and demand.

The market economy is an economic order. Often it is also referred to by other terms, such as

A market economy is an economic order in which production and consumption are determined by the price freely established in the market.

Individual economic subjects decide on the provision of services and consumption.

The markets are the coordination centers, where supply and demand are matched. This form of market economy is the ideal of liberalism. In this free market economy, state intervention becomes superfluous when interests are balanced and the maximum supply of goods is automatically achieved.

However, the restriction of competition through cartels and the formation of monopolies led to crises and an unsocial distribution of power. If the system was basically affirmed, the demand for state intervention grew stronger and stronger.

Protecting our children and teaching them the basic skills if very important to one’s economy. A country with a prosperous economy has a strong foundation that focuses on education. They train the younger generation to perform well. Learning these basic skills through primary education is very critical for a child’s social, physical and intellectual development. Their understanding of basic health nutrition and sanitation is also incorporated into the educational curriculum. All this factors would have an effect to the nation’s economy. The completion of education has proven lasting benefits to the basic unit of the society which is the family. This is also beneficial to the country’s economy.

2019 - 2021 Capital Chronicle